Acceptance of Open Banking Among Canadians: Insights from Recent Survey

Acceptance of Open Banking Among Canadians: Insights from Recent Survey

Posted on: Tuesday Apr 16th 2024

Article by: Bernice Cheung

ARTICLE BY

BERNICE CHEUNG

Canada is expected to introduce an open banking framework (also known as consumer-driven banking) on April 16th. This change will transform how many Canadians manage their financial data. This article outlines current acceptance rates of open banking among Canadians, how Canadians expect to use the capabilities available to them under this new regulatory framework, and other potential changes on the horizon.

What is Open Banking?

Open banking allows consumers to securely share their financial data with third-party financial technology companies, commonly known as fintechs. Under open banking, instead of users having to share login credentials with fintechs, secure digital channels facilitate data-sharing, giving consumers greater control and choice over their financial services. While open banking is already the norm in countries like the UK and Australia, Canada has been moving more slowly; leaders say they have been meticulously preparing a framework that ensures its safe and beneficial deployment.

Current Landscape in Canada

Canada’s current lack of an open banking system means that users are forced to rely on less secure data-sharing practices like screen scraping: This method involves sharing one’s banking credentials with fintech apps, posing significant security and privacy risks. The anticipation of a regulated open banking framework aims to mitigate these risks by providing a structured and secure environment for data sharing.

The Benefits of Open Banking

The transition to open banking promises several benefits:

Enhanced Consumer Choice:

Consumers will be able to access a broader range of financial products tailored to their needs, fostering competition among providers.

Improved Financial Management Tools

: Real-time financial data aggregation from various sources can offer more insightful financial advice and budgeting tools directly to consumers.

Increased Security:

By eliminating the need for screen scraping, open banking reduces the risk associated with sharing login credentials.

Regulatory Framework and Consumer Protection

The Canadian government is set to announce a formal open banking framework on April 16, focusing on consumer protection, data security, and industry participation standards. This framework will likely include strict guidelines on data handling, consent management, and the roles of financial institutions and fintechs. By putting consumer rights first, the framework aims to establish a robust open banking environment that supports innovation while safeguarding sensitive information.

Acceptance of Open Banking Among Canadians

Survey Overview

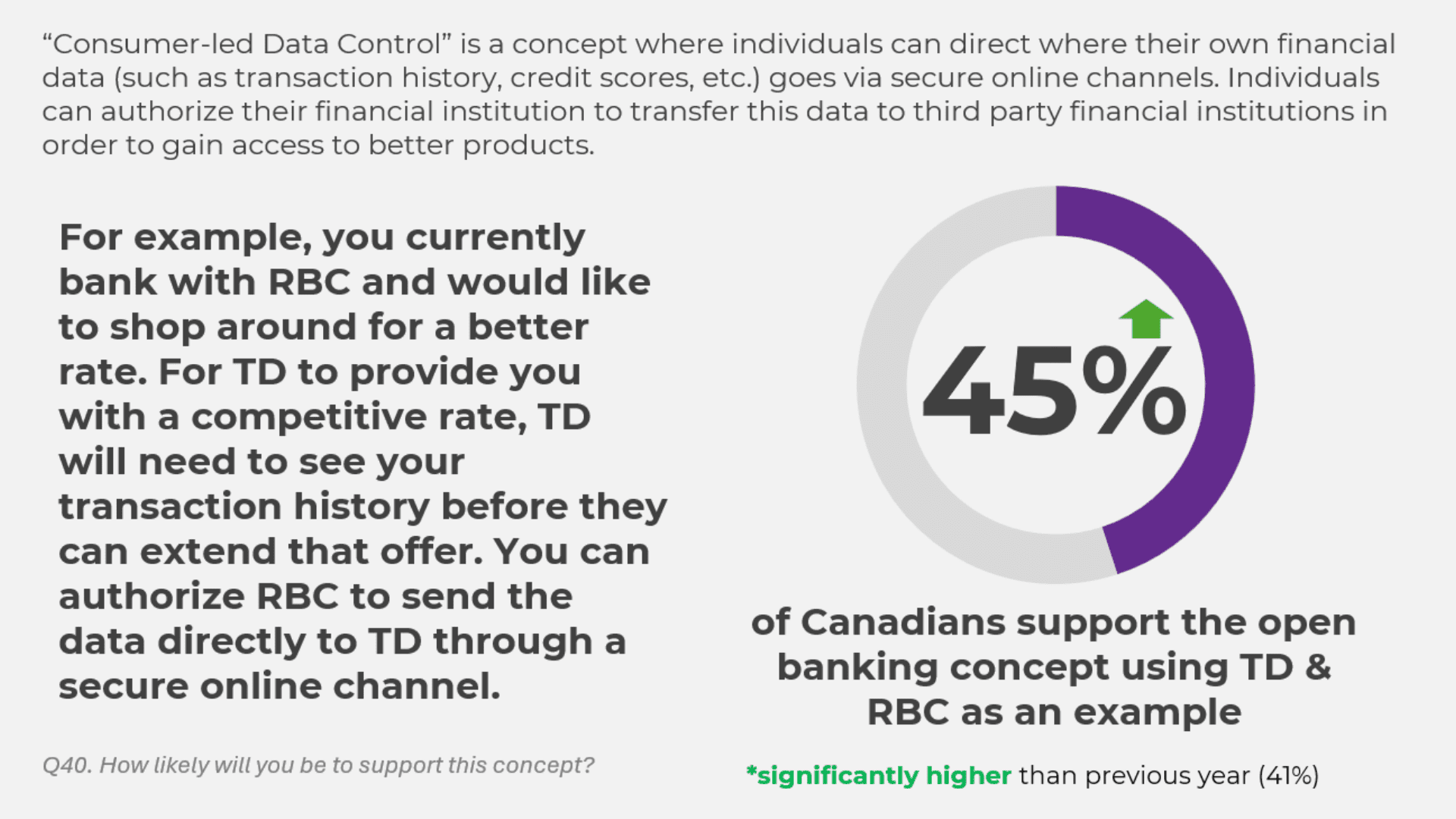

In March 2024, Environics Research interviewed 2,000 Canadians about their acceptance of “consumer-led data control” (also known as open banking). The survey explained to respondents that the system enables individuals to direct their financial data, such as transaction history and credit scores, to third-party financial institutions securely to access better products.

Survey Results

The survey results indicate a growing acceptance of open banking concepts:

Overall Acceptance:

45% of respondents are supportive of authorizing their financial institutions to transfer their data to third parties to secure better financial products. This finding marks a significant increase in acceptance from 2023.

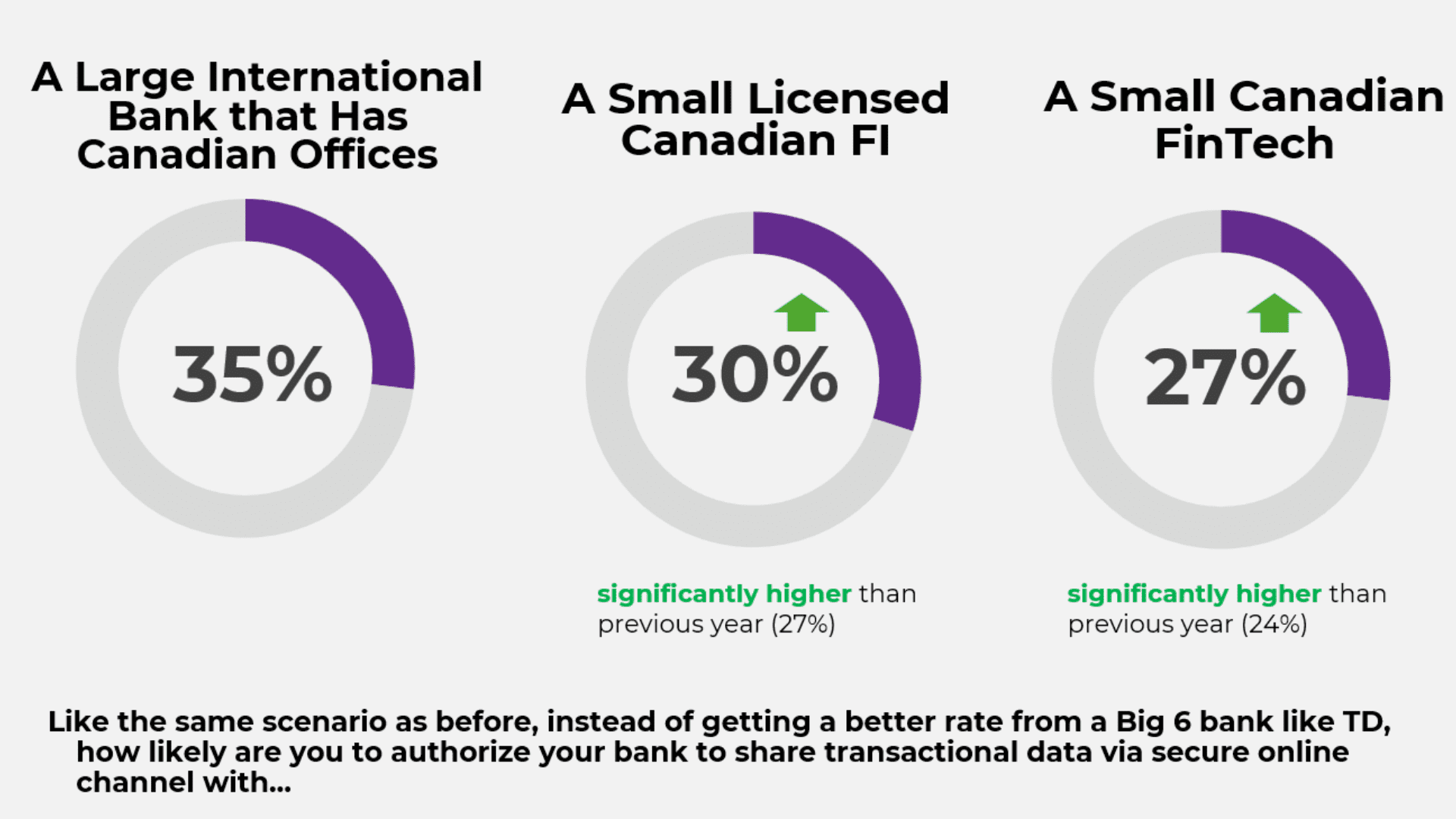

Likelihood of Consumer Adoption, By Institution Type:

-

Large International Banks:

35% are somewhat or very likely to share data with major international banks with offices in Canada, such as American Express.

Small Licensed Canadian Financial Institutions:

30% of respondents are somewhat or very likely to share data with smaller banks.

Canadian Financial Technology Companies:

27% are somewhat or very likely to share data with fintech companies like Borrowell or Wealthsimple.

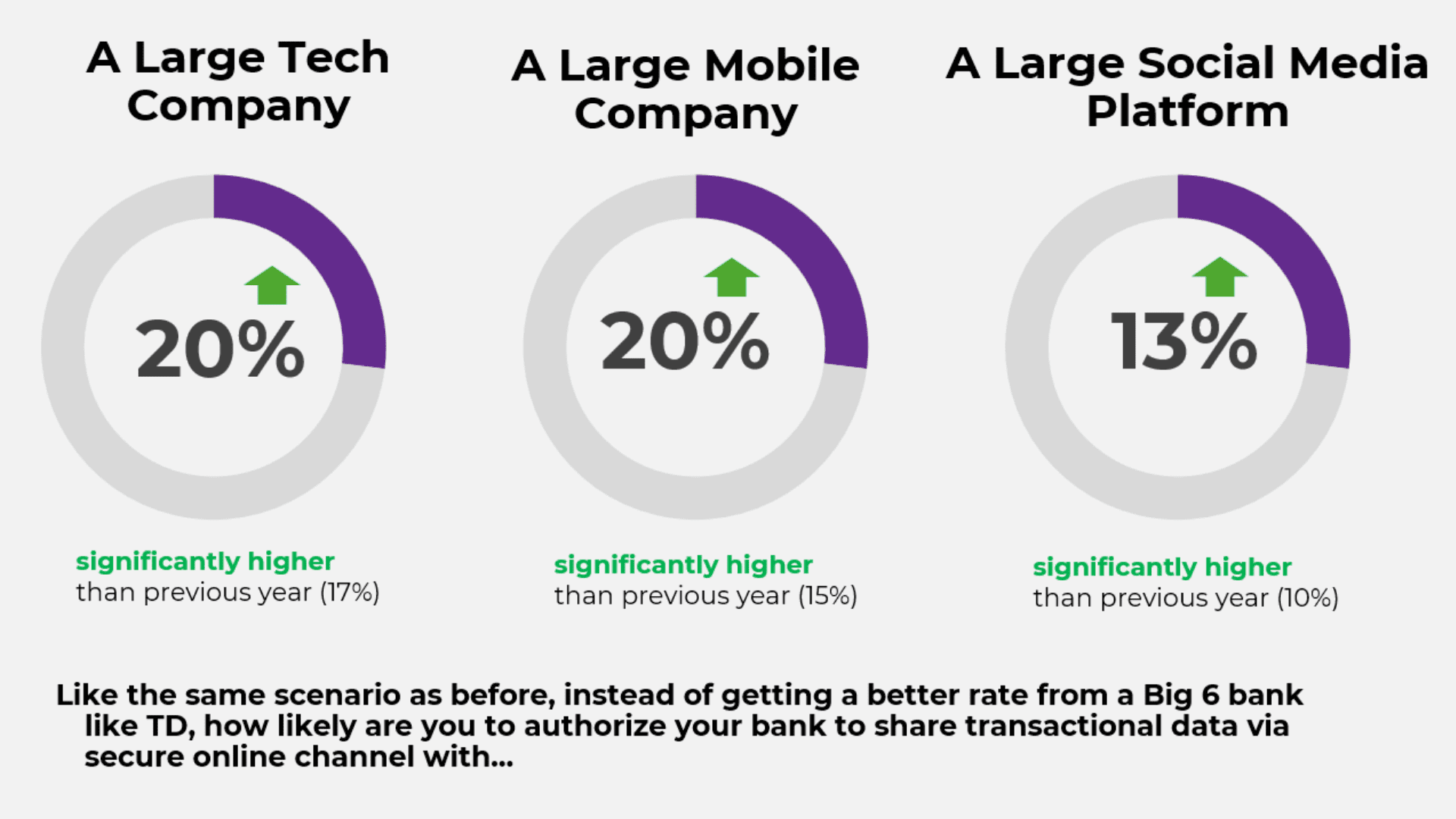

Large Tech Companies:

Only 20% are somewhat or very likely to share data with tech giants like Google or Amazon.

Large Mobile Companies:

Similarly, 20% would likely share their data with companies like Samsung or Google in a mobile tech context.

Social Media Platforms:

The least trust is shown towards social media platforms, with only 13% indicating a likelihood of sharing their financial data with companies like Facebook or LinkedIn.

Analysis of Consumer Trust

The data reveals varying degrees of trust in different types of institutions among Canadians. Traditional and fintech institutions receive moderate to high trust levels, suggesting a recognition of their established roles in financial services. However, there is notable skepticism towards non-financial companies, especially tech giants and social media platforms, highlighting privacy and security concerns.

Implications for the Open Banking Framework

These findings provide valuable insight as Canada finalizes its open banking framework. The higher trust in traditional and fintech institutions over tech companies suggests that the country’s forthcoming regulations need to address consumers’ concerns about data privacy and security. There are three key angles to consider:

Regulatory Focus:

Ensuring robust privacy protections and transparent data handling practices will be crucial to building trust.

Consumer Education:

Enhancing consumer understanding of how open banking works and its benefits could further increase acceptance, particularly among those skeptical about sharing data with tech companies.

Stakeholder Engagement:

Continuous engagement with stakeholders, including banks, fintechs, and consumers, will be vital to refine the framework and address ongoing concerns.

Conclusion

Canadians’ increasing acceptance of open banking signals a readiness to embrace new forms of financial data management, provided these are well controlled and deliver clear benefits. However, the varying levels of trust toward different institution types underscore the need for stringent safeguards and consumer education. With careful implementation, open banking in Canada has the potential to offer greater financial flexibility and security, aligning with global financial innovation trends.

Check out Bernice Cheung’s other article,

“How values shape Canadians’ attitudes toward open banking”

, to better understand the social values of those who either embrace or reject the concept.