Recently, I had lunch with a friend from my MBA days, and our conversation quickly turned to our favorite subjects—business and the latest in technology. We were both wearing our new Ray-Ban Meta glasses, which are designed to take photos and videos via voice commands. We eagerly discussed the Canadian rollout of Meta AI on our glasses, an enhancement that turns us into data collectors and AI trainers for Meta—a role we did not shy from!

This passion for emerging technology places us firmly within the “Enthusiastic Experimenter” segment. We represent the roughly one-quarter of Canadians who are always eager to explore new technologies and are optimistic about the advancements these technologies promise.

The 2024 Environics Research FinTech Study

Environics Research conducts an annual study that looks at Canadians’ awareness, adoption, and trust of FinTechs, as well as other technological topics such as Artificial Intelligence (AI). Analyzing the data from these surveys over time, we’ve categorized Canadian consumers into four distinct segments based on their usage of FinTech brands and their underlying Social Values.

Social Values

are the deep psychological motivations that guide decision-making.

Exploring Canada’s FinTech Adopters

Our data reveals four distinct groups within the Canadian consumer landscape, each interacting with FinTech products according to their personal values and their readiness to embrace new technologies:

Enthusiastic Experimenters

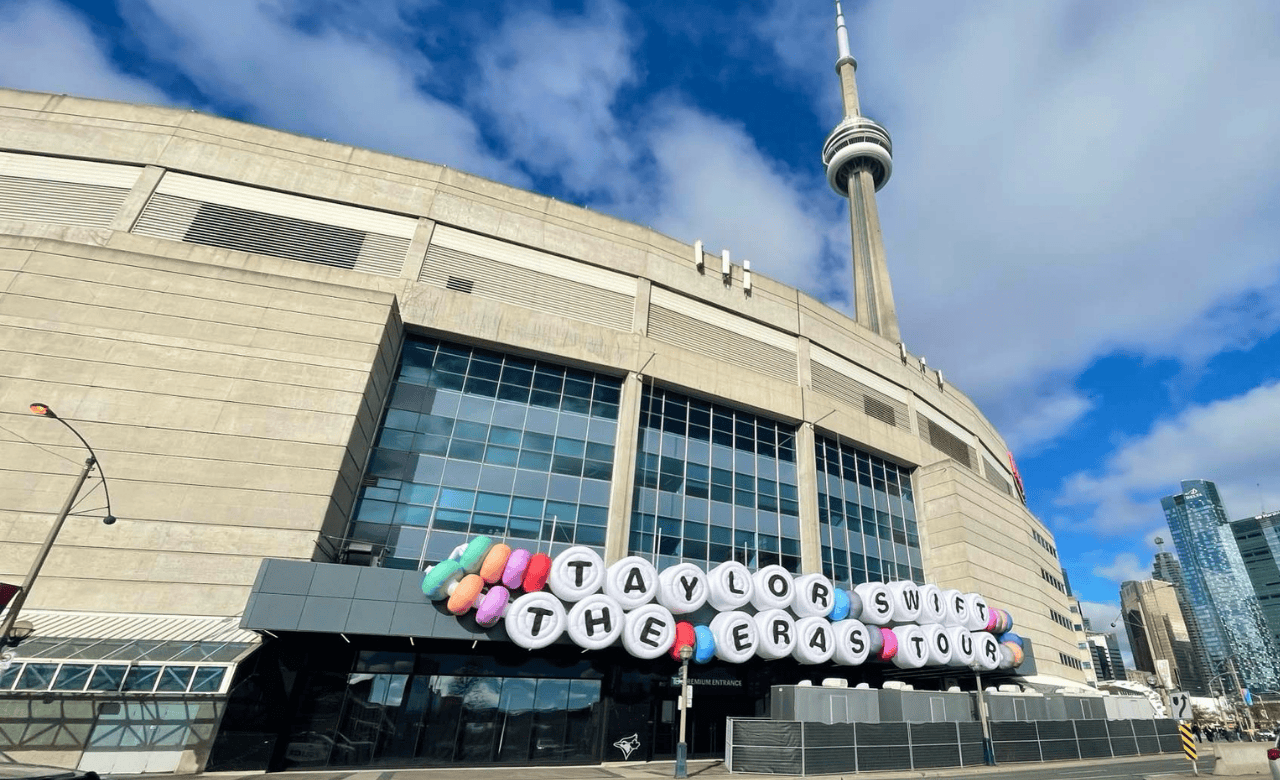

(25% of Canadian adults). Quick to adopt new technologies, these Canadians often lead the way in exploring innovations. South Asian and Chinese Canadians are overrepresented in this group. Members of Gen Y and Gen X are also more likely than average to fall into this segment. They tend to live in urban centres like Toronto and Calgary, are more likely to vote Liberal. They also have higher incomes, which give them the capacity to explore and acquire new tech.

Social Values:

- Enthusiasm for New Technology

- Pursuit of Novelty

- Social Learning

- Brand Genuineness

- Pursuit of Originality

Adaptive Achievers (33%).

These individuals are success-oriented and curious, though they approach new financial technologies with a measure of caution. They are drawn to aspirational brands, with beautiful designs and sleek user experiences; price is a factor in their decisions, but usually not a determining factor. Canadians of South Asian and Eastern European descent are overrepresented in this group, as are members of Gen Y and Gen Z. This segment is the most likely of the four to say they don’t plan to vote, perhaps disappointed about the political choices available.

Social Values:

- Enthusiasm for New Technology

- Personal Creativity

- Consumption Evangelism

- Time Stress

- Status via Home

Anxious Traditionalists (29%).

More conservative in their approach, the Anxious Traditionalists are slow to adopt new technologies but will follow once these technologies become mainstream. Their privacy and control over their own data is critical for them, with 73% saying they’d rather forfeit better pricing on financial products than share their information. Their trust in big business has kept them from venturing into standalone FinTech brands; they have confidence in Canada’s major banks and are not motivated to explore alternatives. This segment tends to skew slightly older, with a good mix of early and late Boomers. They also display varied political leanings, and over-index in Western European heritage.

Social Values:

- Control of Privacy

- Technology Anxiety

- Civic Engagement

- Skepticism Towards Advertising

- Ecological Concern

Reserved Skeptics (13%).

Very cautious about new technologies, these Canadians need plenty of evidence and reassurance before adopting. They skew older, with pre-Boomers and Boomers overrepresented, and reside disproportionately in rural areas. They place little value in a brand name, and often need more proof of the financial and practical benefits of new technologies before adopting them.

Social Values:

- Emotional Control

- Utilitarian Consumerism

- Technology Anxiety

- Brand Apathy

- Skepticism Toward Small Business

FinTech Brand Awareness in 2024: Generally Growing

Over the past year, there has been significant growth in brand awareness across the FinTech sector, with various tech-enabled wealth management companies penetrating new and larger consumer segments. Brands such as WealthSimple and Questrade have seen substantial increases in recognition, while others like BMO SmartFolio and RBC InvestEase also enjoy heightened visibility among specific segments.

Brand Awareness By Segment: Which Groups Know Which Brands?

Enthusiastic Experimenters.

This group is highly engaged with FinTech, with a whopping 62% indicating awareness of WealthSimple, and 54% aware of Questrade. This indicates that these brands are resonating well with those who are keen on exploring new financial technologies.

Adaptive Achievers.

FinTech brand awareness is also strong in this segment, with 48% recognizing WealthSimple and 40% aware of Questrade. Members of this segment are drawn to platforms that offer robust and sophisticated financial tools, aligning with their ambitions for advanced financial solutions.

Anxious Traditionalists.

They have a more cautious approach to adopting new services, with lower brand awareness than other segments across all FinTech brands we tested. Established banking names received a good recognition rate: 12% and 11% for BMO SmartFolio and RBC InvestEase respectively. A tendency to be more aware of offerings from Canada’s major banks likely reflects this segment’s trust in big business.

Reserved Skeptics.

While less than eager to adopt new tools, this cautious segment is not unaware of FinTech brands: a little over a third (35%) were aware of both WealthSimple and Questrade. To move from awareness to adoption, brands will need to be patient, taking the time to build trust and communicate a crystal-clear value proposition.

Conclusion

The surge in FinTech brand awareness in Canada illuminates the critical role of targeted communication and the need to align product offerings with consumer values. For both traditional financial institutions and emerging FinTech companies, understanding the distinct segments of their customer base is paramount.

Are your marketing strategies finely tuned to the unique needs and preferences of each segment?

Are you effectively leveraging these insights to craft compelling messages that resonate?

By addressing these questions and tailoring communications accordingly, financial services can enhance customer engagement, and accelerate their growth. This approach isn’t just strategic — it’s essential for fostering robust customer relationships and driving forward-thinking innovation in a rapidly evolving industry.