With Artificial Intelligence (AI) reshaping many areas of business, we decided to use part of an April 2024 survey of group plan sponsors in Canada to understand their thoughts on how AI would affect their work. The insights we gathered reveal a number of ways for insurance companies to tailor their offerings to meet evolving needs.

About the Environics Research 2024 Syndicated Group Plan Sponsor Study

Between April 4th and May 14th, 2024, Environics surveyed 1,017 group plan sponsors, each responsible for decisions regarding their company’s group benefit and retirement plans. Respondents included Canadian company owners, human resource leaders, heads of finance, and other managers; collectively, these professionals decide what millions of Canadian employees’ company group plans will look like. Our survey, now in its fourth year, is the most extensive of its kind in Canada, tracking which offerings sponsors are considering and using, exploring sponsors’ relationships with insurance providers, and gauging where sponsors’ and members’ needs are being met – or not.

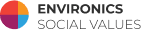

Employees’ Sentiment Toward AI

In the business context, AI uses advanced algorithms and machine learning to analyze data, automate processes, and enhance decision-making. While AI is understood to hold significant potential to increase efficiency and identify opportunities for improvement and innovation, for many companies and professionals the implications of this technology are still coming into view. When group plan sponsors are asked to estimate how employees in their companies generally perceive AI, sentiments are positive or neutral:

We see variations by company size, sector, and role.

- Large and medium businesses, each at 57%, are more likely to report positive sentiments towards AI among their employees . Smaller businesses find their employees feeling more neutral about AI, with 43% holding this view.

- People working in secondary industries such as manufacturing express more optimistic views about AI, with 53% feeling positive. Employees in non-profit organizations are more likely than average to express neutral feelings (50%).

- Professionals working in personnel or HR management are notably positive, with 57% expressing excitement about AI’s role in their work.

Understanding how sentiments toward AI vary across the economy can guide the development of tailored group plans that resonate with the specific needs and concerns of different sectors and company sizes.

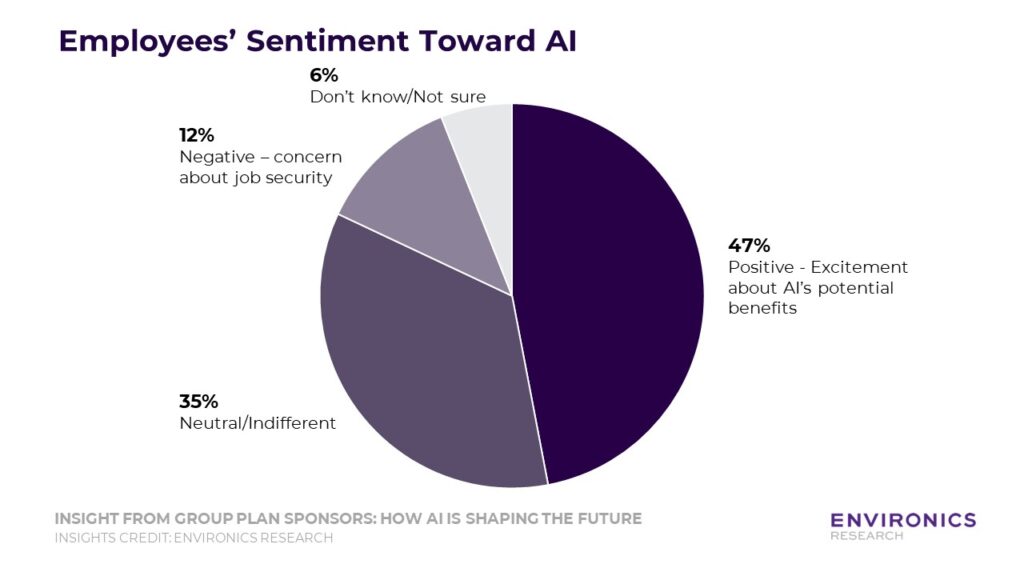

How Companies Are Using AI

The study also explored how companies are currently leveraging AI. The top areas of current utilization, as reported by group plan sponsors:

- Customer service (chatbots, call analytics): 36%

- Marketing (content generation, ad optimization, product recommendations): 27%

- Operations/logistics (automation, inventory management, operations management): 25%

- Innovation (e.g., product development): 25%

- Risk management (fraud detection, regulatory compliance): 24%

- Finance/accounting (financial analysis, accounting, demand forecasting): 22%

- Sales (lead generation, predictive analytics): 21%

- None of the above (“we have not used AI for anything in our company”): 24%

- Don’t know/Not sure: 5%

These diverse applications of AI indicate multiple entry points for insurance companies to integrate AI into their offerings. Highlighting AI’s potential role in improving efficiency and reducing costs can resonate well with plan sponsors who are already embracing this technology.

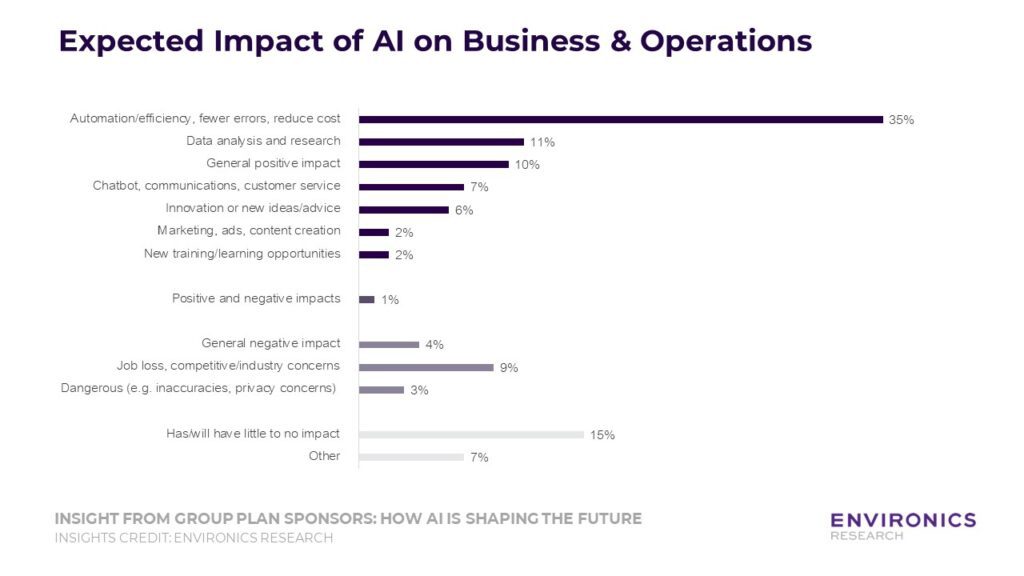

Anticipated Impact of AI

We asked group plan sponsors to express in their own words how they anticipate AI will affect their business and employees. In the chart below, we’ve grouped their responses into general categories to create an overview of their expectations.

Key Takeaways for Insurance Companies

The findings of this latest survey have a number of potential implications for insurers.

Customized AI Solutions

Insurance companies can offer AI-driven solutions tailored to different business sizes and sectors. Large and medium businesses, more positive about AI, may welcome advanced AI tools for predictive analytics, personalized recommendations, and risk assessment. Tailoring AI-driven solutions to specific industries can maximize impact. For instance, companies in secondary industries and those with unions are more positive about AI. Developing sector-specific case studies and testimonials can demonstrate the tangible benefits of AI in similar environments.

Enhancing Customer Service

With nearly half of employees excited about AI, insurers can introduce AI-powered customer service tools like chatbots and virtual assistants. These tools improve efficiency, offer 24/7 support, and handle routine inquiries, freeing up human agents for more complex tasks. Given that 36% of group plan companies are already using AI in customer service, insurers have a clear opportunity to enhance user experience and streamline processes.

Educational Campaigns

For small businesses and non-profits with mixed feelings about AI, insurers can launch educational campaigns to showcase AI’s benefits. Providing case studies, webinars, and demos can build trust and demystify AI. Such efforts respond to the neutral or indifferent sentiment held by 35% of employees and the 12% who are concerned about job security due to AI.

Addressing Job Security Concerns

With 12% of employees worried about job security due to AI, insurers can address these fears. Clear communication about how AI augments rather than replaces human jobs, along with examples of new opportunities created by AI, can help alleviate concerns. Emphasizing transparency and ethical AI practices can build trust.

Leveraging HR Enthusiasm

HR professionals are notably positive about AI. Insurers can target these departments with AI solutions for benefits administration, employee engagement analytics, and talent management tools. This can streamline HR processes and improve overall employee satisfaction.

Operational Efficiency

AI’s ability to improve operational efficiency is a major selling point. Insurers can showcase how AI reduces errors, cuts costs, and enhances productivity in claims processing, underwriting, and fraud detection. Emphasizing these benefits can resonate with the 35% of respondents who see AI as a way to enhance automation and reduce costs.

Building Trust Through Transparency

Transparency about AI systems and their impact on data privacy and security is crucial. Insurers can build trust by clarifying their commitment to the ethical use of AI and setting out the measures they take to protect sensitive information. Clear and honest communication can address concerns and build confidence among clients.

Innovation and Competitive Edge

Leveraging AI can position insurance companies as market innovators. By continuously integrating AI advancements, insurers can differentiate themselves from competitors and attract forward-thinking clients. Offering AI-driven solutions that incorporate predictive analytics, personalized recommendations, and enhanced customer service capabilities can showcase the innovative edge of insurers.

Opportunities for insurers to engage with group plan sponsors are abundant. Especially in an environment where there is a lot of hype about AI, it’s essential to understand rapidly changing attitudes and keep pace with how real people are seeing and experiencing the shift.

Get in Touch

At Environics Research, our annual study Syndicated Group Plan Sponsor Study help us understand how group plan sponsors think about their plans and providers. Contact us for more detailed insights or to collaborate on future studies.

Contact Bernice Cheung, VP Financial Services Research at [email protected].