Sisters in finance: Why women investors and advisors make great investing partners

Posted on: Wednesday Nov 22nd 2023

Article by: Kait Moreau

ARTICLE

BY

KAIT MOREAU

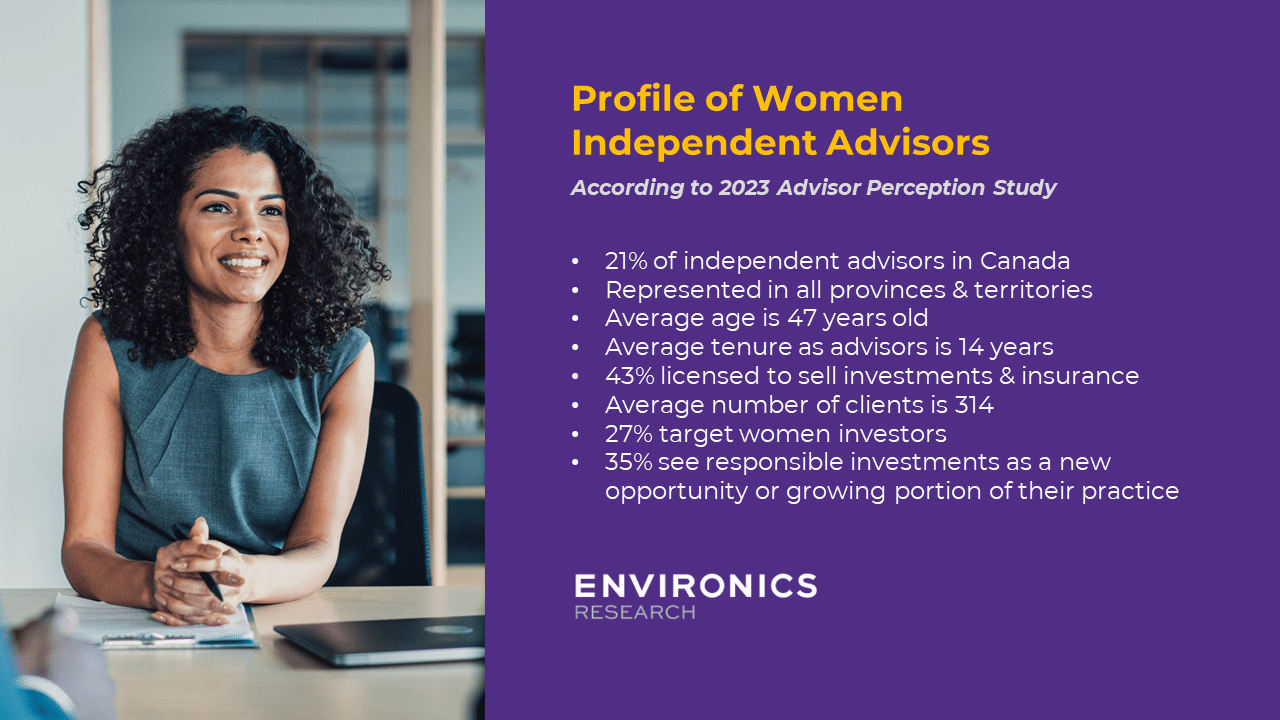

For women starting their investing journey or re-evaluating the support they receive in managing their investments, working with an independent financial advisor can be a promising option to explore. Independent advisors can offer their clients a broad range of products, allowing them to carefully tailor product portfolios to each investor’s needs. Our research indicates that independent financial advisors who are women might be an especially good fit for women investors; many run practices that align closely with the priorities of women advisors.

While women and men’s financial priorities overlap to some degree, we also see differences between the two groups. The top financial priority for Canadian women is saving for unexpected events or emergencies, while men are more likely to be interested in saving for retirement.

Women’s financial goals also vary by generation.

Gen Z

and

Millennial

women’s priority is increasing the amount they save,

Gen X

are focused on saving for retirement, and

Boomers

are intent on reducing their spending and protecting themselves and their family financially in case of unexpected illness, disability of death. Although advisors typically aim to customize their approach to each client’s goals – regardless of whether they share the client’s identity or experience – when clients work with an advisor of similar age, it can increase the likelihood of common values and a shared understanding of priorities and challenges.

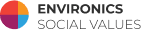

How accessible are women advisors to investors who might wish to work with them? Women independent financial advisors make up only about 21% of the industry – but they are located all across Canada. On average, they have ten-plus years of experience and represent a range of different life stages.

[Thinking about “success”, how do you define success for you and your practice?]

“Enable clients to feel comfortable with their portfolio and [they] appreciate your help in taking them through their journey of achieving their goals and objectives. Business evolved around life planning with your clients and empowering them to be successful!”

–

Woman advisor

Women advisors generally run smaller practices, work with a concentrated group of clients and tend to tailor their practice toward the specific needs to women investors. They tend to have a strong focus on building relationships and the majority say this is the role they prefer the most. These patterns align closely with what women investors say they look for in their advisor: trust, relationship, understanding unique needs and industry knowledge.

Moreover, more than four in ten women advisors are dually-licensed, meaning they are able to offer both investment and insurance products to clients. Since nearly seven in ten Canadian women hold both investment and insurance, seeking out an advisor who can offer both will provide a one-stop shop. Additionally, women investors often look for their advisor to provide support beyond investments, such as financial planning and tax and estate planning. Many women advisors offer all three services through their practice or have referrals to others who can help.

Women investors and advisors are also aligned when it comes to responsible investments (RI), which take into account environmental, social and governance issues. Women investors, hoping to build portfolios that reflect their values, are generally interested in receiving information about responsible investments – and women advisors are more likely than men to view RI as a new opportunity for their practice, or an area they are already working to grow. Both groups agree about the main reasons to invest in RI: to potentially make a positive impact on the world and to feel better about the kind of companies they are invested in. In addition, women advisors say RI allows them to incorporate clients’ personal values into investments.

For investors, finding an advisor who understands and can build a customized approach that will advance their unique financial goals is important for long-term success. Canadians should periodically reassess their advisor relationship to ensure they are receiving the service and support they need. Women investors should consider meeting and interviewing women advisors. Our Advisor Percpetion Study Research suggests these advisors are likely to share many of the same values as their women clients. And their overall approach to working with clients tends to demonstrate the very qualities women investors tell us matter most to them.

Tags:

More Articles

Thought Leaders

Managing the Middle: Gen X and the Healthcare Squeeze

02/02/26

Vijay Wadhawan

Research

What the Data Reveals About 2SLGBTQIA+ Health in Canada

02/02/26

Vijay Wadhawan

Industry Trends

Data Portability Isn’t a Policy Detail. It’s a Pressure Release

01/28/26

Bernice Cheung