It’s been a few weeks since the 2024 Women in Payments Symposium, so I’ve had some time to reflect on the experience. What a privilege it was to sit on the “FinTech Innovation: Explore Adoption Challenges” panel alongside industry powerhouses like Jamie Chomas, Roya Kachooei, and Claire Robinson, it was expertly moderated by Laurence Boudrias. The discussions were dynamic, and it’s clear that while FinTech faces some big challenges, the future is incredibly bright. There’s so much innovation happening, and I left the event feeling hopeful about what’s to come.

Consumer Trends Driving FinTech Innovation

During our panel, I had the pleasure of sharing the latest consumer behavior trends from the Environics Research 2024 FinTech Syndicated Study. I outlined four key trends that have the most significant impact on FinTech innovation and adoption:

1) Pandemic’s Impact on FinTech Adoption

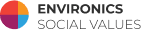

The pandemic caused a huge surge in FinTech adoption, and while we’ve seen a slight dip as people return to in-person interactions, the impact is lasting. In 2019, only 32% of Canadians were “very likely” to use online-only tools for payments like bills or mortgages. That number jumped to 44% in 2022 and has now settled at 39% in 2024. Even more encouraging? The percentage of people who are unlikely to use these tools has dropped from 28% in 2019 to just 20% today. It’s clear that FinTech has become an integral part of how we manage our finances, and it’s only going to grow from here.

2) Immigration’s Expectations Drive FinTech Growth

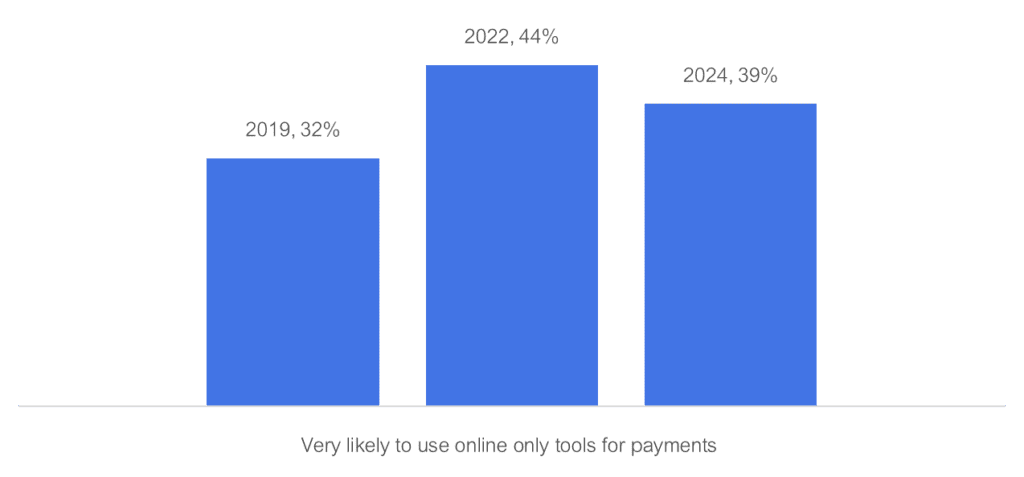

Immigration is driving FinTech adoption in Canada in such an exciting way. While immigrants make up 26% of our study, we see significant difference in their composition when we look at each of the FinTech segments separately. For example, 36% of Enthusiastic Experimenters (the most forward-thinking and tech-savvy consumers) are immigrants, especially in cities like Toronto and Calgary. These consumers are coming from countries where FinTech is already ahead of the curve, and they’re bringing those expectations with them. They want the seamless, digital-first experiences they’re used to, and that’s pushing Canadian FinTechs to innovate faster.

3) Financial Hardship and their skepticism towards AI

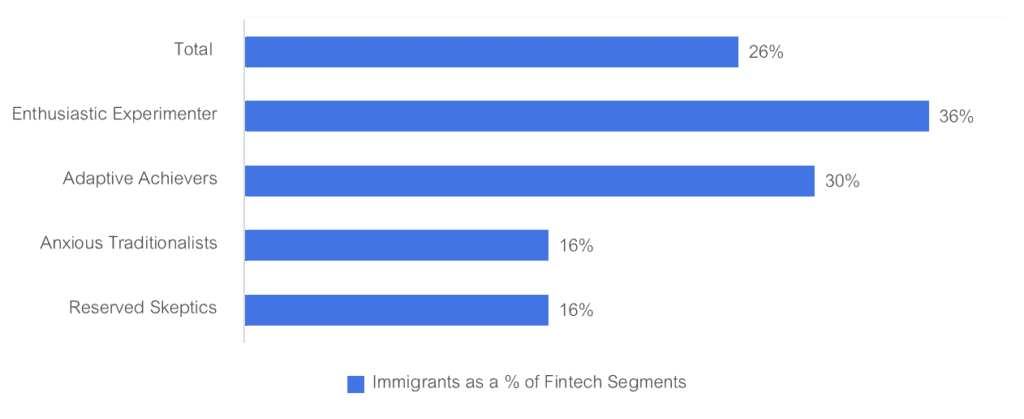

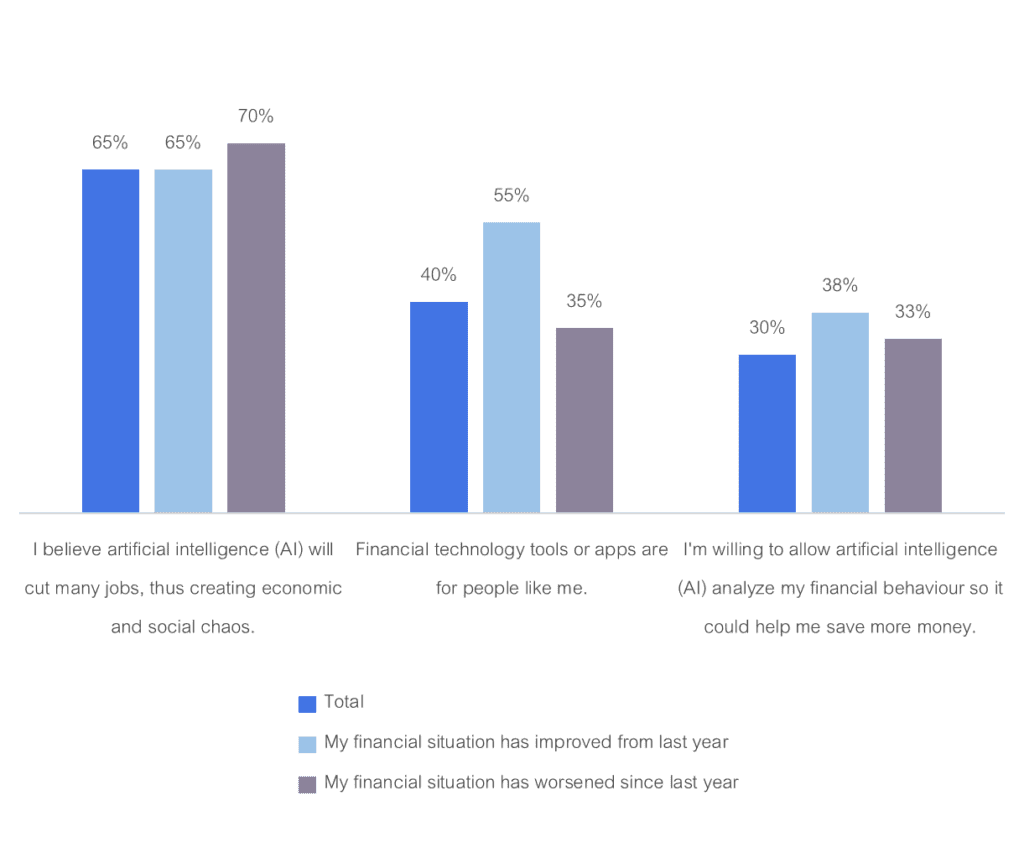

One of the most eye-opening insights was the unfortunate correlation between financial hardship and negative views of technology—especially AI. Right now, 28% of Canadians feel their financial situation has worsened in the past year (up from just 15% in 2020). Those people who are struggling financially, tend to be more skeptical of AI, a tool that could potentially help them out of their dire financial standing.

For example, 71% of those who feel their situation has worsened agree that AI could lead to job loss and social chaos, compared to 66% of the general population. At the same time, 73% of those feeling financial strain fear AI could be a long-term danger to humans, versus 68% overall.

But on the flip side, those who feel their financial situation has improved are much more optimistic about AI’s potential. In fact, 40% of this group are willing to let AI analyze their financial behavior to help them save more money, compared to 33% of the total population.

It’s disheartening that the group that probably needs technology the most to streamline and advance their financial situation, are often most fearful of technology.

4) Conservative Attitudes Toward Cybersecurity and Mistrust of FinTechs

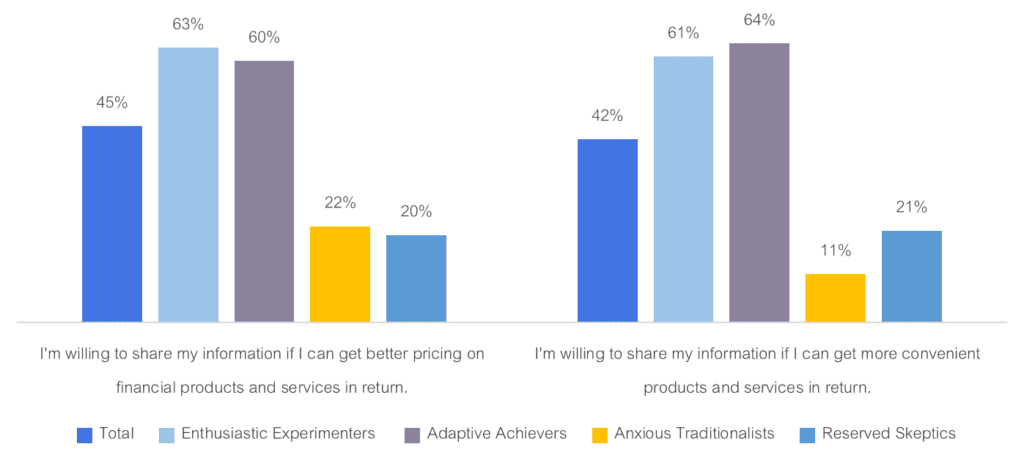

A significant portion of the population still has conservative attitudes around data privacy and FinTech. The Anxious Traditionalists segment (29% of the population) is particularly concerned about cybersecurity. While 45% all Canadians would provide their personal info for better pricing on financial products, a striking 78% of them would rather give up this chance. They rank high on technological anxiety and the need to control privacy, while being less interested in pursuing novelty or trusting advertising.

Despite this, there is hope— while 46% of all those surveyed have heard of WealthSimple (compared to 35% of Anxious Traditionalists), 23% of Anxious Traditionalists who have heard of WealthSimple actually stated that they trust the platform (compared to 32% of general population). This shows that while there is skepticism towards FinTech, there’s also room to build trust with this group. More mature FinTechs like WealthSimple is slowly making inroads with this security-driven segment.

The Road Ahead: A Bright Future for FinTech

What really excites me is the potential that lies ahead. Open banking, for example, is such a huge opportunity in Canada. We’re a bit behind countries like Brazil and India, where open banking has already taken off, but there’s so much room for growth here. Open banking could bring incredible benefits to small businesses and consumers, from automated budgeting to smoother cross-border payments.

And with the rise of real-time payments, the need for strong cybersecurity is greater than ever. We talked a lot about fraud prevention at the symposium, and I’m optimistic that by working together—FinTechs, banks, and governments—we can create a safer, more inclusive financial system for everyone.

A Final Thought: Collaboration Will Shape Our Future

One of the most inspiring things about the Women in Payments Symposium was the energy and passion from everyone I met. The networking alone was worth the trip! It’s clear that if we continue to collaborate and share our knowledge, we’ll be able to overcome the challenges ahead and shape the future of FinTech in ways that benefit us all.

I can’t wait to see what’s next for this industry—and I’m excited to keep these conversations going. If any of these insights resonate with you, let’s connect and explore how we can work together to drive innovation and make a real impact.