Trust, Data Sharing, and FinTech Segments

Learning about cybersecurity unfortunately has its real-world application. As I dive deeper into my cybersecurity course, I’m struck by how these lessons intersect with my work studying consumer behavior in financial services and FinTech’s at Environics Research. The recent Finastra data breach serves as a stark reminder of how critical trust and security are in this space—and how consumer reactions are shaped by their underlying Social Values.

The Finastra breach, which affected sensitive client data across over 8,000 institutions globally, underscores the vulnerabilities even major players face. On November 8th, 2024, Finastra disclosed unauthorized access to its Secure File Transfer Platform (SFTP), affecting sensitive client information. The hacker claimed to have stolen 400 gigabytes of data, highlighting vulnerabilities in even the most trusted systems. While Finastra acted quickly to mitigate the damage, I can’t help but think about how consumers will respond—especially when trust in online financial platforms already varies so widely. Our FinTech Syndicated Study helps to understand how Social Values shape trust, skepticism, and engagement in the FinTech world. This breach made me wonder, could Social Values help with a solution?

Segmental Trust and Data Sharing Attitudes

The Environics Research FinTech Syndicated Study provides deep insights into the attitudes, behaviors, and adoption patterns of Canadians toward financial technology. Based on responses from 2,000 Canadians, the study explores key factors influencing FinTech adoption, including trust, privacy concerns, generational differences, and the role of innovation.

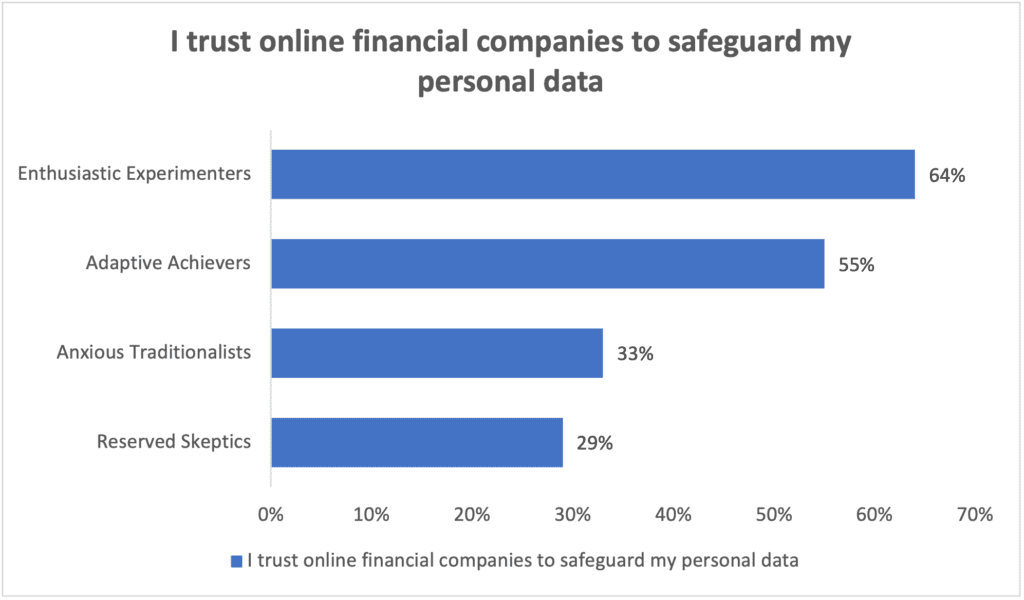

Consumer trust in online financial platforms varies significantly by our FinTech segments, as does their willingness to share data for convenience. When asked, “I trust online financial companies to safeguard my personal data,” agreement levels revealed stark differences:

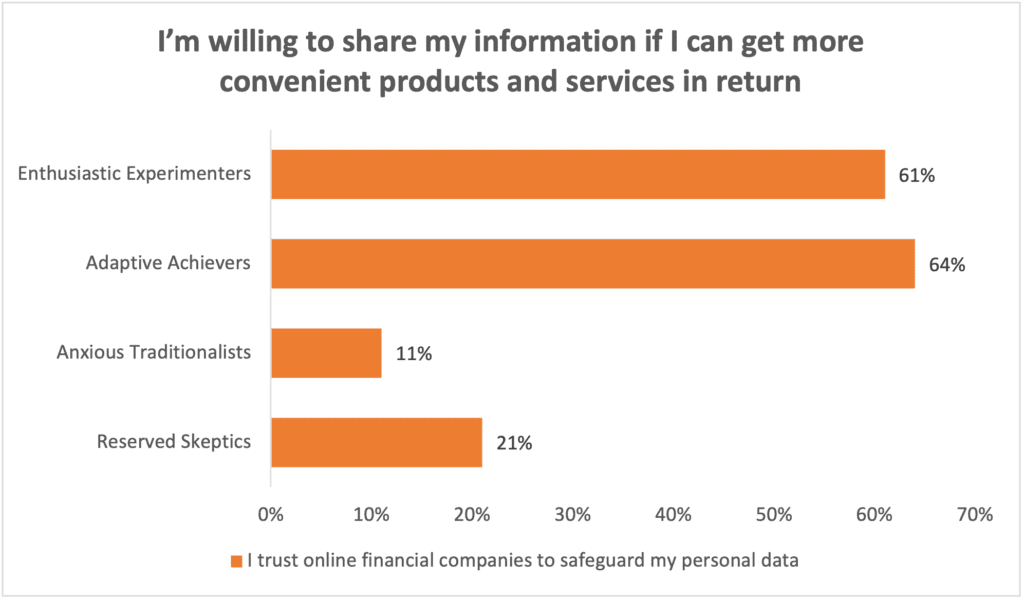

On the question, “I’m willing to share my information if I can get more convenient products and services in return,” the responses similarly highlight contrasting attitudes:

These insights reveal a critical paradox: segments like Enthusiastic Experimenters and Adaptive Achievers are more willing to share data for better services, while Anxious Traditionalists and Reserved Skeptics are deeply cautious. However, as the Finastra breach demonstrates, even those who avoid sharing personal data can be affected due to the interconnectedness of financial systems. This reality underscores the importance of securing data throughout the ecosystem, including third-party providers.

Enthusiasm For New Technology

Personal Creativity

Pursuit Of Novelty

Consumption Evangelism