Many believe that Artificial Intelligence (AI) will revolutionize industries and transform our daily lives in ways we’re just beginning to grasp. From automating routine tasks to uncovering deep insights through data analysis, AI is already making its power felt – and some experts believe that it will drive a wave of innovation that will soon change almost everything. This excitement has sparked curiosity among Canadians, many of whom are eager to explore what AI can do.

Our 2024 Fintech Syndicated study interviewed 2,000 Canadians in March 2024.

NOTE: ChatGPT generated the following images and we asked it for a little disclaimer as to why they they didn’t generate correctly:

“The images featured in this article were generated using ChatGPT’s AI-based image generation tool. They have not been manually altered or edited in any way. Please note that while the tool aims to accurately represent the prompts provided, some differences between the prompt description and the resulting images may occur due to the nature of the AI generation process.”

Growing Curiosity and Engagement

The Data Prompt:

- 32% of Canadians agree with “I’ve experimented firsthand with artificial intelligence (AI) tools such as ChatGPT.”

- This has many more regional and demographic differences: 38% of Ontarians, 40% of greater Vancouver, 44% Greater Toronto Area,

- 35% male, 50% under 35 years old, 39% of 35-49, 46% of immigrants (not born in Canada),

- 63% of new-to-Canada less than 10 years ago, 44% university degree, 46% post grad degree,

- 40% with $100k or above annual income, 38% of home owners with a mortgage, 37% of renters, 59% who live in an urban location, 48% in suburban.

Canadians are clearly curious about AI, with about a third reporting that they have already experimented with AI tools like ChatGPT. Young people and city dwellers are particularly enthusiastic, with 50% of those under 35 having knowingly tried AI, and strong adoption rates in places like Greater Toronto (44%) and Greater Vancouver (40%). Newcomers to Canada are also jumping on board, with 63% having explored AI tools, as many may have come from countries that leapfrogged Canada technologically.

Widespread Concerns

The Data Prompt:

- 68% of Canadians agree to the statement: “In the long term, I fear that the development of artificial intelligence (AI) will pose as a danger to humans.”

- With females (70%), seniors 65+ (78%), those who live in Atlantic provinces (80%), those who expect their financial situation would worsen (76%)

However, this excitement is tempered by significant concerns. Whatever AI’s positive potential, nearly 70% of Canadians worry that it could pose a long-term danger to humans. This concern is especially strong among women, seniors, and residents of Atlantic Canada, where 80% express apprehension. Financial worries also play a role, particularly for those who expect their economic situation to worsen as AI displaces workers in some fields.

A Preference for Human Oversight

The Data Prompt:

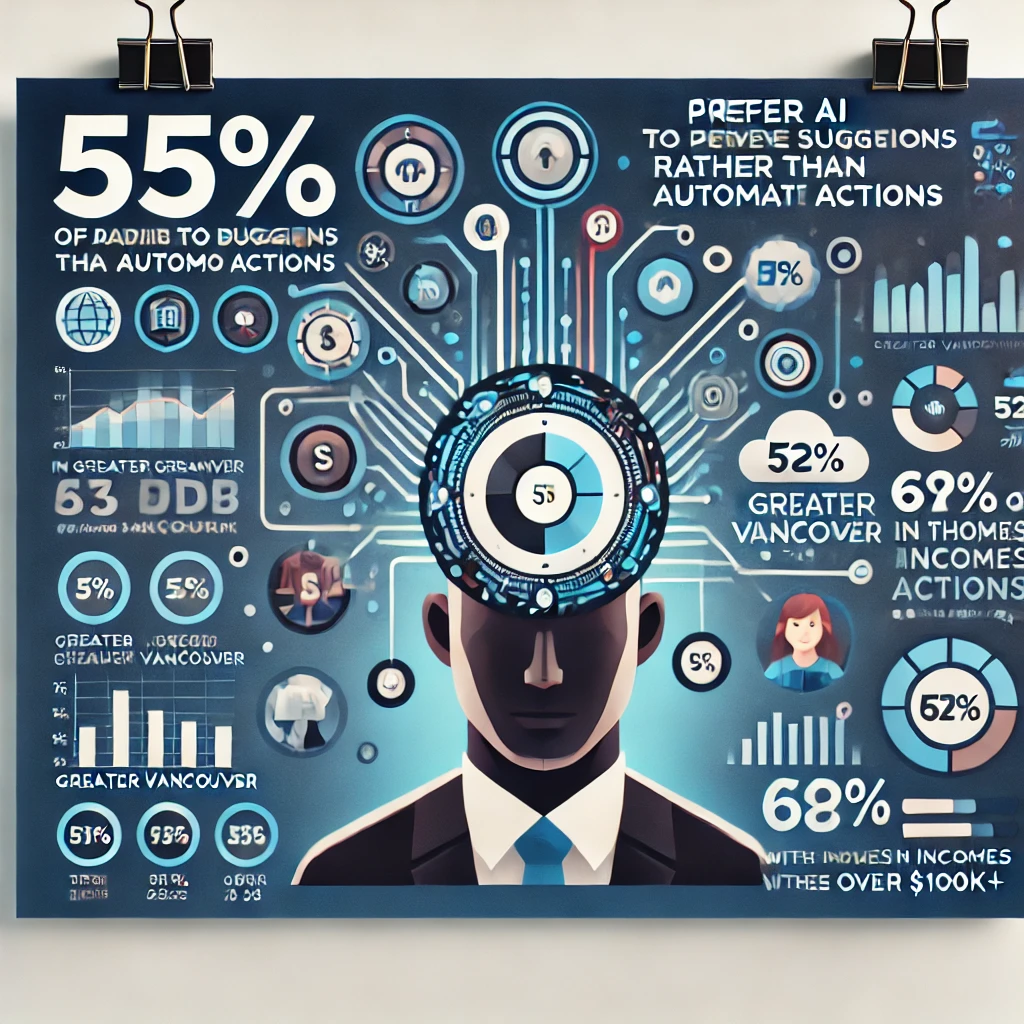

- 55% agreed with the statement “I prefer that artificial intelligence (AI) powered tools only supply suggestions about how I should manage my finances and not automate the action in my accounts.”

- Those in greater Vancouver (63%) and greater calgary (70%) are more likely to agree; as well as younger (61% of under 35 year olds; and 58% of 35-49 year olds) agree, as well as those with higher incomes $100k+ (61%)

Amid these mixed feelings, Canadians are clear about one thing: they prefer to keep human control at the forefront of AI applications, especially when it comes to managing their finances. More than half (55%) of Canadians prefer AI tools that offer suggestions rather than taking actions on their behalf. This preference is especially strong in cities like Greater Calgary, where 70% of residents favour AI as an advisor, and among younger people, with 61% of those under 35 sharing this view.

This desire for human control and involvement goes beyond finances. An overwhelming 80% of Canadians believe it’s important to have a human customer service representative, even if it means waiting longer for a response. Among those 65 and older, this preference rises to 90%, highlighting that AI-driven chatbots may not yet meet the expectations of many, particularly older Canadians.

Hesitancy in Personal Financial Management

When it comes to letting AI take a closer look at their personal finances, Canadians are still cautious. Only 33% are open to AI analyzing their financial behavior to help them save money. Even in tech-savvy cities where people are more likely than average to say they’re open to AI feedback on their financial choices – for instance, in Greater Vancouver (where 42% are open), Calgary (48%), and Toronto (43%) – majorities still remain hesitant. Younger Canadians are somewhat more willing to get personalized financial tips from AI, with 49% of those under 35 open to the idea, alongside 41% of those aged 35-49.

Interestingly, the 33% who are open to AI’s role in managing their finances share some specific Social Values that make them particularly appealing to fintech companies. These individuals are enthusiastic about new technology, value novelty, and embrace an ecological lifestyle. They’re drawn to brands that feel genuine and enjoy discovering new things, while also valuing creativity and adaptability. They tend to be receptive to advertising, and eager to share their experiences—making them ideal early adopters of innovative, AI-driven financial solutions.

For fintech companies, this group represents a lucrative target audience, as they’re more likely to be open to trying innovative products — and, if they like those new offerings, they have a tendency to promote them enthusiastically to their networks. They align well with Environics Research’s Enthusiastic Experimenter FinTech Segment.

Contrasting Perspectives

The findings about consumer fear towards AI contrast with the more optimistic views held by group plan sponsors, who generally see AI as a powerful tool for innovation and efficiency. This difference highlights the importance of understanding how various segments of society perceive AI and addressing the specific concerns of those who are more cautious about its impact.

Explore how these senior decision makers view AI in their business context.

Addressing Concerns and Building Trust

For businesses and policymakers, addressing Canadians’ concerns about AI is essential for promoting the adoption of this technology. Organizations that have good answers to key public questions — for example, around job security, data privacy, ethics, and financial control — will be well positioned to earn public trust as they pursue growth and innovation.

Some key steps organizations can take to reassure users and customers as they introduce AI products and features:

1. Build AI with Human Oversight in Mind:

Action: When developing AI-powered products or services, ensure there are clear pathways for human intervention. This could mean designing AI tools that offer recommendations but allow the user to make the final decision, especially in sensitive areas like financial management.

Why: Canadians overwhelmingly prefer to maintain control over important decisions, particularly when it comes to their finances. By integrating human oversight into your AI systems, you cater directly to this preference, increasing user trust and adoption.

2. Prioritize Data Privacy and Transparency:

Action: Implement robust data protection measures and be fully transparent with customers about how their data is used. Provide clear, easy-to-understand privacy policies and ensure customers have control over their data.

Why: With 70% of Canadians concerned about the potential dangers of AI, building trust is crucial. By prioritizing data privacy and being transparent, you can alleviate fears and differentiate your brand as one that respects and protects user information.

3. Target Early Adopters with Tailored AI Solutions:

Action: Develop and market AI-driven products that align with the Social Values of the roughly one-third of Canadians who are more open to AI. Our research shows that in addition to values such as enthusiasm for new technology, Canadians who are open and curious about AI also score high on some more surprising values, such as ecological lifestyles, and personal creativity. Organizations can win with targeted offerings and campaigns that resonate with this group’s values, emphasizing the innovative and personalized aspects of their AI solutions.

Why: The 33% of Canadians willing to embrace AI in their financial lives represent a valuable market segment, particularly for fintechs. By tailoring your offerings to their preferences and values, you can capture this lucrative audience and drive adoption.

Moving Forward Together

As AI continues to evolve, it’s crucial to balance innovation with sensitivity to public sentiment. By listening to the concerns of Canadians and responding seriously, in areas such as product development and data governance, we can harness the positive potential of AI while managing the risks and concerns that may stand in the way of adoption.

Get in Touch

At Environics Research, we continue to explore public attitudes toward AI. Contact us to learn more about our findings and how they can inform your strategies. Reach out to Bernice Cheung, VP Financial Services Research at [email protected].