How values shape Canadians’ attitudes toward open banking

Posted on: Thursday Apr 4th 2024

Article by: Bernice Cheung

ARTICLE BY

BERNICE CHEUNG

Canada has been slower than some jurisdictions to adopt open banking. But by learning from others who have moved first, Canada now has the opportunity to enable an especially strong open banking ecosystem that empowers consumers. This is an argument Kevin Carmichael, Canada’s outgoing “open banking czar,” makes in a recent argument with

The Logic

.

How interested are Canadians in the kind of empowerment Carmichael describes? Which Canadians are most likely to be interested, and why? In this post, we explore the consumer attributes that shape Canadians’ perspectives on open banking.

First, a definition. Open banking essentially enables consumers to share their banking information as they choose. The practice relies on “interoperability”: the use of standard data formats that let different organizations (with consumer permission) share information seamlessly. Open banking advocates argue that by authorizing the practice and creating frameworks that support it, governments open the door to fintech innovation and consumer benefits.

The journey towards open banking in Canada has been marked by anticipation and challenges. Government has worked gradually – and with lots of consultation – to create a framework to unlock the potential of open banking while protecting essential priorities like consumer privacy and security.

On April 16th, the federal government will announce legislation to enable open banking as part of its budget. It’s important for industry stakeholders and others to understand consumer sentiment and the attributes that shape it.

“Sounds good…I think?”

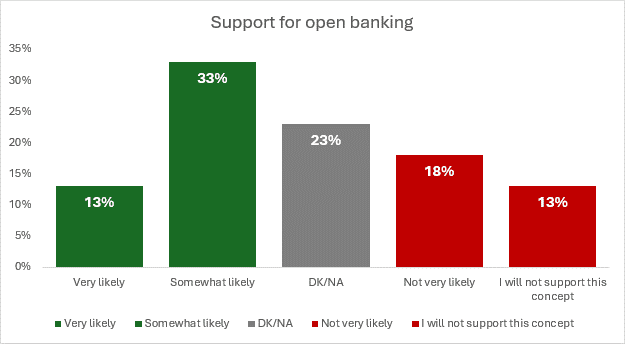

According to our 2024 FinTech Syndicated Study, which surveyed 2,000 Canadians across the country, nearly half of respondents say they’d be either very likely (13%) or somewhat likely (33%) to support open banking. The latter stance may indicate some reservations or uncertainties about a practice that has the potential to be transformative but may not yet be widely understood by the public.

Conversely, about one-third of Canadians express mild or strong opposition: 18 per cent say they are not very likely to support the change, while 13 per cent saying they would definitely not support it. These findings show that a significant minority of Canadians remain apprehensive about the potential implications of open banking on their financial security and privacy.

Interestingly, almost a quarter of Canadians (23%) indicate that they are undecided about their stance on open banking. Such a large share of “don’t know” answers suggests that many consumers are struggling to grasp the mechanics and implications of open banking, and feel they have insufficient information to form a definitive opinion.

The social values of keeners and skeptics

Our survey data allow us to link individuals’ opinions about open banking to their social values profiles. Supporters of open banking tend to exhibit values such as enthusiasm for new technology, confidence in small business, and personal creativity, reflecting a general mindset oriented toward innovation and empowerment.

Supporters of open banking also embrace values related to social engagement and community involvement, including social learning, multiculturalism, and global consciousness. Although these values don’t have an obvious link to financial matters, we tend to find them among Canadians who feel curiosity and openness – not fear – about people and concepts that are new and different.

In contrast, skeptics of open banking score higher than average on values such as technology anxiety, privacy control, and aversion to complexity – a cluster of values that indicates general wariness toward the promises of technology boosters. Skeptics also tend to score high on brand apathy, skepticism towards advertising, and utilitarian consumerism. These values suggest a critical attitude toward business and a desire not to be unduly influenced by commercial messages.

Canadians wary of open banking stand out on values like active government and civic engagement, suggesting relatively high trust in government and non-commercial actors; they would likely need reassurance from governments about the legitimacy of open banking before feeling comfortable with it. Finally, some of the values that stand out among open banking skeptics (such as xenophobia, cultural assimilation and emotional control), tend to occur among Canadians who are generally more traditional and uneasy about change. These findings suggest that some skeptics may be uncomfortable with new offerings in general, no matter how safe or beneficial they may be.

Toward consumer-driven banking

Understanding the attributes and attitudes of Canadians who do not currently support open banking is vital for policymakers and industry stakeholders. Addressing consumer concerns can make open banking frameworks more inclusive and responsive to diverse needs. To make open banking truly “consumer-driven” (a term the government has applied to the practice), leaders must help to inform and educate Canadians.

Today, many consumers lack awareness or understanding of open banking and its potential benefits. Targeted awareness campaigns, educational resources, and transparent communication are important to helping consumers make informed decisions about how they wish to participate in the coming open data ecosystem.

Informing Canadians about how open banking works and how they might benefit is not just about building trust in new offerings. A well-informed public and an industry that truly understands how to navigate and address consumer sentiment are both important to the general advancement of financial innovation in Canada.

Insights from our 2024 Canadian FinTech Syndicated Study can help policymakers, industry stakeholders, and financial institutions gain insight into the deeper perspectives and motivations that may underlie consumers’ resistance to technology-enabled financial innovation. Research insights can also help to inform offerings and messages that resonate with Canadian consumers’ values and aspirations.

Trust and confidence are vital ingredients in banking and financial services – in both their traditional and emerging forms. By empowering consumers with knowledge and understanding the sources of their uncertainty and concern, leaders can help to build the trust and confidence that will help fintech flourish in Canada, delivering benefits for all stakeholders.

Tags:

More Articles

Industry Trends

Part 2: The Doorway Is Built. Now Comes The Permission.

12/10/25

Bernice Cheung

Industry Trends

Part 1: EQ Bank + PC Financial Isn’t Just a Deal. It’s a Doorway.

12/10/25

Bernice Cheung

Thought Leaders

Generosity in 2025: How Giving Is Evolving This GivingTuesday

12/02/25

Annika Jagmohan