Syndicated Plan Sponsor Prospectus

Assessing Group Benefit Plans

Syndicated Plan Sponsor Prospectus

Assessing Group Benefit Plans

Introduction

In this annual syndicated study of plan sponsors & administrators – decision makers of employee group plans, we will help uncover strategic insights so you can better serve your clients and prospects’ needs. The study will focus on key metrics such as brand usage, key decision-making factors, satisfaction, likelihood to recommend, etc. on plan sponsors across Canada.

“92% of employees at small- to mid-sized companies ranked workplace savings and retirement plans as an important factor in remaining with their employer”

How can we

help you?

Insights from Previous Work

- 80% of employers agree that group savings and retirement plans improve a company’s ability to attract new employees, help employees plan for and achieve their goals, and increase retention of skilled employees

- 33% of employees put an employer contribution to a pension plan at the top of their wish list

- 72% of employees with a group plan at their current workplace said it was a major factor in their decision to accept their employment

- 26 million Canadians have supplementary health insurance, 90% of it through group plans

- 80% of working Canadians and their families are protected by private health insurance plans

- $38.1B health benefits in 2019 – which includes supplemental health, disability and accident insurance

- 72% of employees with a group plan at their current workplace said it was a major factor in their decision to accept their employment

Study Overview

20 minute online survey

- English & French

- 3 open-ended questions

- Types of products covered:

- Group health (e.g. dental, vision, paramedic, etc.)

- Group retirement (e.g. DB, DC, Group RRSP, etc.)

Target Respondent

Group plan sponsors / administrators

- Decision makers or influencers of employer group health and retirement plans

- Typically belong in the HR or finance functions (e.g. VP or Director of HR, CFO, VP of Finance, etc.)

- At least 50% will have group retirement plans

- Representation across Canada

- Representation across different business sizes

Topics Covered

- Screener

- Profile of company & plan sponsor

- Advisor/consultant relationship

- Current product usage & future consideration

- Satisfaction with provider, NPS, important factors & satisfaction of factors

- Future innovation sought

- Special topics of interest to charter clients

Sample Plan – Regional Split

n=1,000

- Ontario ~39%

- Quebec ~22%

- BC ~15%

- Alberta ~12%

- Prairies ~6%

- Atlantic ~6%

Sample Plan – Business Size Split

n=1,000

- Small Businesses (1-99 employees) ~39%

- Medium Businesses (100-499 employees) ~30%

- Large Businesses (500+ employees) ~31%

Timeline

- Early bird deadline: January 31, 2024

- Commitment by: March 1, 2024

- Finalized questionnaire: March 15, 2024

- Translation & Programming: Mar 18-29, 2024

- Fieldwork: April 2024

- Report: Late May / Early June 2024

- Presentation: June 2024

Satisfaction with provider, NPS, important factors & satisfaction of factors

An important section of the study is understanding group plan sponsor’s satisfaction with providers on a variety of attributes. We gathered insights about respondents’ perceptions of providers of both health benefits and savings/retirement benefits. In all, we measured 48 dimensions of performance, including:

- Product-specific factors such as quality of record keeping (for health plans) and quality of annual reporting to members (for retirement savings plans).

- Back office and service factors such as quality of client service for plan members, and training and education opportunities for plan sponsors.

- Corporate factors such as the provider’s reputation and corporate image.

Although summarizing all 48 dimensions isn’t possible here, a look at Net Promoter Scores (NPS) gives a general sense of how plan providers are seen. The first step in generating Net Promoter Scores for this study was to ask respondents, “Based on everything you know about each of the following, how likely are you to recommend these plan providers to other plan sponsors?”

Respondents answer on a 10-point scale, with 10 being most likely to recommend. The loyal enthusiasts who answer 9 or 10 are categorized as Promoters, while those who answer 6 or below are categorized as Detractors. (Those who answer 7 or 8 are categorized as Passives and discarded from the calculation.) Subtracting the percentage of Detractors from the percentage of Promoters yields the NPS, which can range from a low of -100 (every customer a Detractor) to a high of 100 (every customer a Promoter).

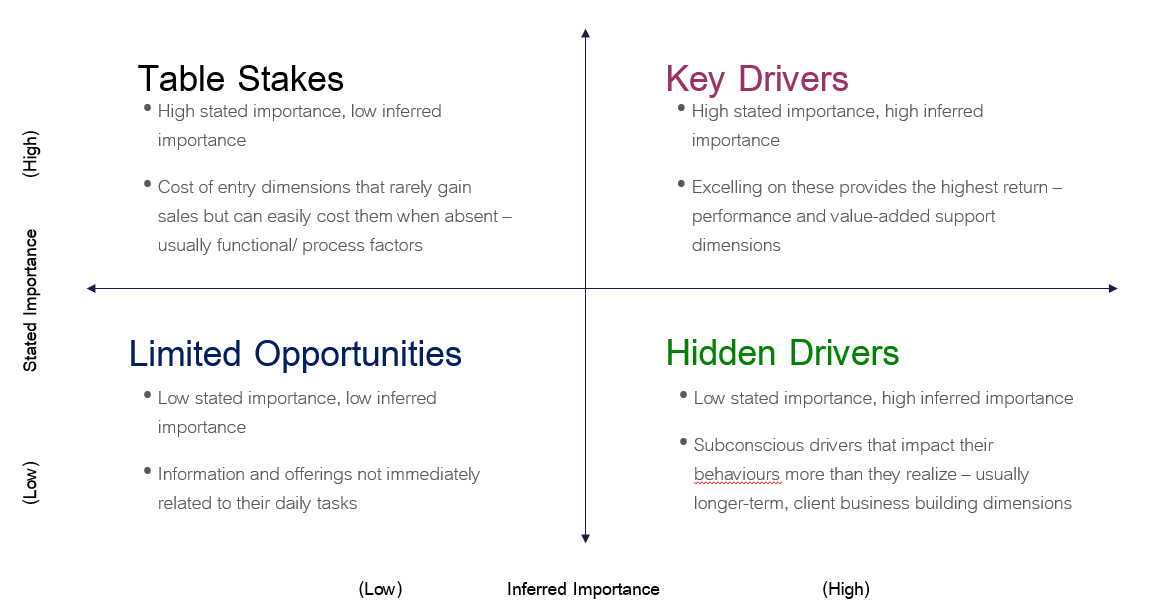

After understanding how group plan sponsors evaluate providers on each of the 48 attributes, we use the below drivers analysis framework to determine which attributes are key drivers of satisfaction. Each of these attributes will be distributed into one of these four quadrants – Table Stakes, Key Drivers, Limited Opportunities and Hidden Driver. If a provider is rated highly on “Key Drivers” attributes, they will be much more successful than providers who are rated highly only on “Limited Opportunities” attributes.

Tracked Firms

- Alberta Blue Cross

- Assumption Life

- Beneva (SSQ+La Cap)

- Canada Life

- Chambers of Commerce

- Chubb Insurance

- Desjardins Insurance

- Empire Life

- Equitable Life Insurance

- Green Shield Canada

- iA Financial Group

- LifeWorks

- Mackenzie Investments

- Manitoba Blue Cross

- Manulife Financial

- Medavie Blue Cross

- National Bank Trust

- Nest Wealth at Work

- Pacific Blue Cross

- RBC Royal Bank

- Saskatchewan Blue Cross

- Sun Life Financial

- The Co-operators

- UV Mutuelle

- Wealthsimple

Key Screening Questions

A. Please indicate the types of pension/retirement/benefit plan arrangements offered by your company. Select all that apply. At least 50% must have a retirement plan (e.g. 1-5 below)

- Defined Benefit (DB) plan

- Defined Contribution (DC) plan

- Group RRSP/DPSP/EPSP

- Hybrid retirement plan, for example a retirement plan that combines aspects of both a DB and a DC plan

- Pooled Registered Pension Plan (PRPP/VRSP)

- Life/Health/Dental benefits

- None – TERMINATE

B. When it comes to decisions regarding your organization’s group plan, which of the following would you say represents your role? Each question can be answered under Group Life, Health or Dental Benefits or Group Saving or Retirement Benefits.

- Authorize, I am one of the primary decision makers

- Recommend, I am part of the decision-making process, but not the final decision maker

- Consulted, I am consulted on and influence decisions, but not directly involved in the process

- I am not really involved in or influence these decisions – TERMINATE

Reach Out Now

Bernice Cheung, MBA, CAIP

VP, Financial Services & Cultural Markets

Bernice.Cheung@Environics.ca

416.844.6396

Find out how Bernice and our Financial Services Team can help your organization.

Toronto

366 Adelaide Street West

Suite 101, Toronto, ON

Canada M5V 1R9

416 920 9010

Ottawa

135 Laurier Ave W.

Ottawa, ON

Canada K1P 5J2

613 230 5089

Calgary

421 7th Ave SW

Suite 3000, Calgary, AB

Canada T2P 4K9

403 613 5735