A strong rapport with advisors may be more valuable than you think

Mutual fund wholesalers

ARTICLE

BY Kait Moreau

Advisors who know a manufacturer’s wholesaler by name have on average 118% more mutual fund AUM with that supplier.

The value that investment wholesalers deliver in Canada is widely recognized by manufacturers and advisors alike. Wholesalers provide key support to advisors who are working with their manufacturer’s products to the extent that many advisors see them as key business partners: trusted sources of information, education, and investment solutions. At the same time, wholesalers provide clear value to manufacturers by prospecting new advisors and connecting advisors to new products and product lines.

As we start to wrap up another year of the Advisor Perception Study and compile the Wholesaler Effectiveness Study results, our syndicated survey launched over two decades ago which produces individual report cards for wholesalers in Canada, we reflect on how wholesaling has evolved over the last years. To begin, it’s worth noting that wholesaling teams continue to have diverse configurations and approaches to their markets. We find no consistent standards or characteristics in terms of how teams are set up.

Wholesalers are operating in a context where financial advisors’ experiences are changing, with their practices becoming increasingly complex. Advisors need to balance prospecting; spending time with current clients; staying up to date on markets, products and technology; and dealing with compliance – all while running a small business with the usual day-to-day concerns.

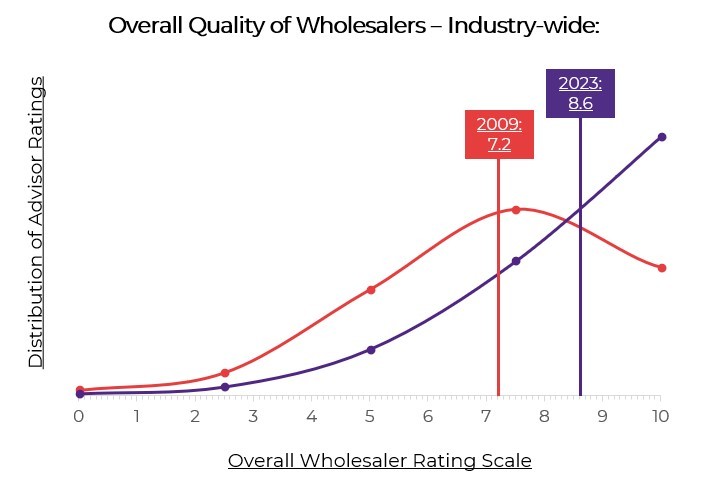

In this context, our research sees the importance of wholesalers growing. Over the last 10 years, the number of investment wholesalers in Canada has increased by 20%. At the same time, advisors’ connections with their wholesalers is deepening. In 2023, more advisors could name their wholesalers unaided than in 2013. Advisors’ average rating of wholesalers’ overall quality has also increased. With many wholesalers vying for advisors’ attention, the fact that many can identify their wholesalers unaided (first and last name) demonstrates a strong relationship.

Wholesalers appear to have a strong influence on advisors’ overall perceptions of manufacturers. An advisor’s ability to name their wholesaler is associated with a 25% improvement in the overall company rating. Familiarity with wholesalers is associated with other patterns as well: the proportion of an advisor’s sales dedicated to the wholesaler’s manufacturer grows by 53% and the average total mutual fund assets under management (AUM) dedicated to the manufacturer rises by 118%. In addition, we’ve heard from advisors that a really effective wholesaler helps retain advisor support for firms who encounter periods of declining performance or other service lapses.

Wholesaler tenure also makes a difference. Half of investment wholesalers have been with their company for less than 5 years; only one in five wholesalers has been with their company for 10 years or more. As wholesaler tenure extends, advisor relationships deepen. Wholesalers get to know an advisor’s business and customize product recommendations and marketing advice. Manufacturers see a lift in overall company rating where wholesaler’s tenure exceeds five years. Wholesalers with a tenure of 10 or more years increase the amount of mutual fund AUM an advisor dedicates to a company.

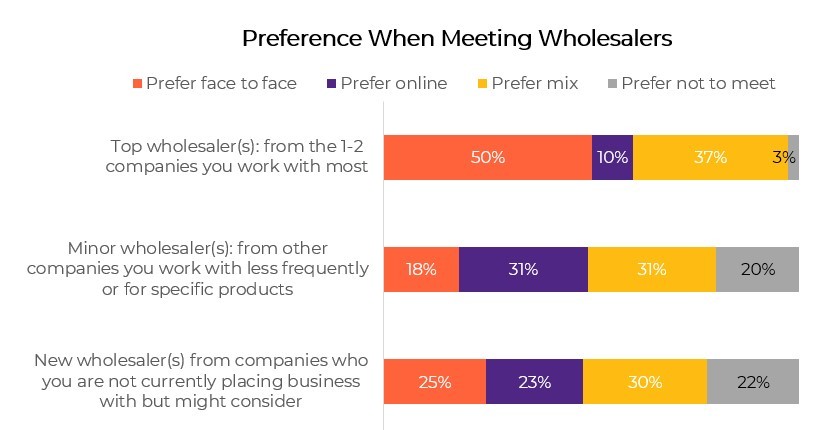

For many advisors, wholesalers are the face of the manufacturer, complementing advertising and marketing initiatives. But it’s getting harder for new entrants to prospect: coming out of pandemic, two in ten advisors tell us that they prefer not to meet with wholesalers at companies they are not currently placing business with. In this context, wholesalers will need to be patient and invest more time with advisors in order to establish a position in advisor’s portfolio.

Nurturing and protecting existing advisor relationships is also vital for wholesalers. For both new and existing relationships, understanding and monitoring advisors’ priorities and how to support them will be key. One useful tool is Environics’ annual Wholesaler Effectiveness Study, which collects ratings of individual wholesalers so they can understand their strengths and possible areas of improvement from advisors’ perspective. A complementary offering, our Touch Point Evaluations, provide a custom, real-time dashboard displaying wholesaler ratings collected on a weekly or monthly basis for tactical targets.

To learn more about these programs, please contact Kait.Moreau@environics.ca, Robert.Stel@environics.ca or David.MacDonald@environics.ca

Find out how our Financial Services team can help your organization

Related insights

Toronto

366 Adelaide Street West

Suite 101, Toronto, ON

Canada M5V 1R9

416 920 9010

Ottawa

135 Laurier Ave W.

Ottawa, ON

Canada K1P 5J2

613 230 5089

Calgary

421 7th Ave SW

Suite 3000, Calgary, AB

Canada T2P 4K9

403 613 5735