Assessing Group Benefit Plans: How do decision makers who choose group plans for their teams view products and providers?

ARTICLE

BY Bernice Cheung

Leaders who make decisions about employer-provided group benefits plans have plenty of factors to take into account. Perhaps the most obvious are cost considerations: do the scope and quality of the benefits seem worth the investment? But plenty of other factors also matter, like the quality and clarity of the plan provider’s record-keeping and the ease of member enrollment.

To understand how decision makers view the offerings of various group plan providers, in 2021 we surveyed 1004 sponsors or administrators who make or shape their organizations’ decisions about which plans to offer to employees. Respondents, all based in Canada, typically included heads of HR or Finance in large or medium businesses, or owners of smaller businesses.

In addition to gathering useful feedback about group plan providers – both in overall performance (in the form of NPS scores) and on specific dimensions – our survey revealed some other interesting patterns

-

- Product-specific factors such as quality of record keeping (for health plans) and quality of annual reporting to members (for retirement savings plans).

- Back office and service factors such as quality of client service for plan members, and training and education opportunities for plan sponsors.

- Corporate factors such as the provider’s reputation and corporate image.

What We Cover in this Article:

Group Health – Quick Problem & Error Resolution

Group Health – Ease of Plan Administration

Group Savings – Quality of programs/tools to promote financial wellness

Group Savings – Quality of Annual Reporting

NPS Rankings for Health Benefits

NPS Rankings for Retirement and Savings

Why do Sponsors go to competing insurers

Company’s Approach to Choosing a Plan

Top Health Risks Facing the Company

Sponsors’ Roles Shape Their Perceptions

Survey Highlights – Group Health Benefits

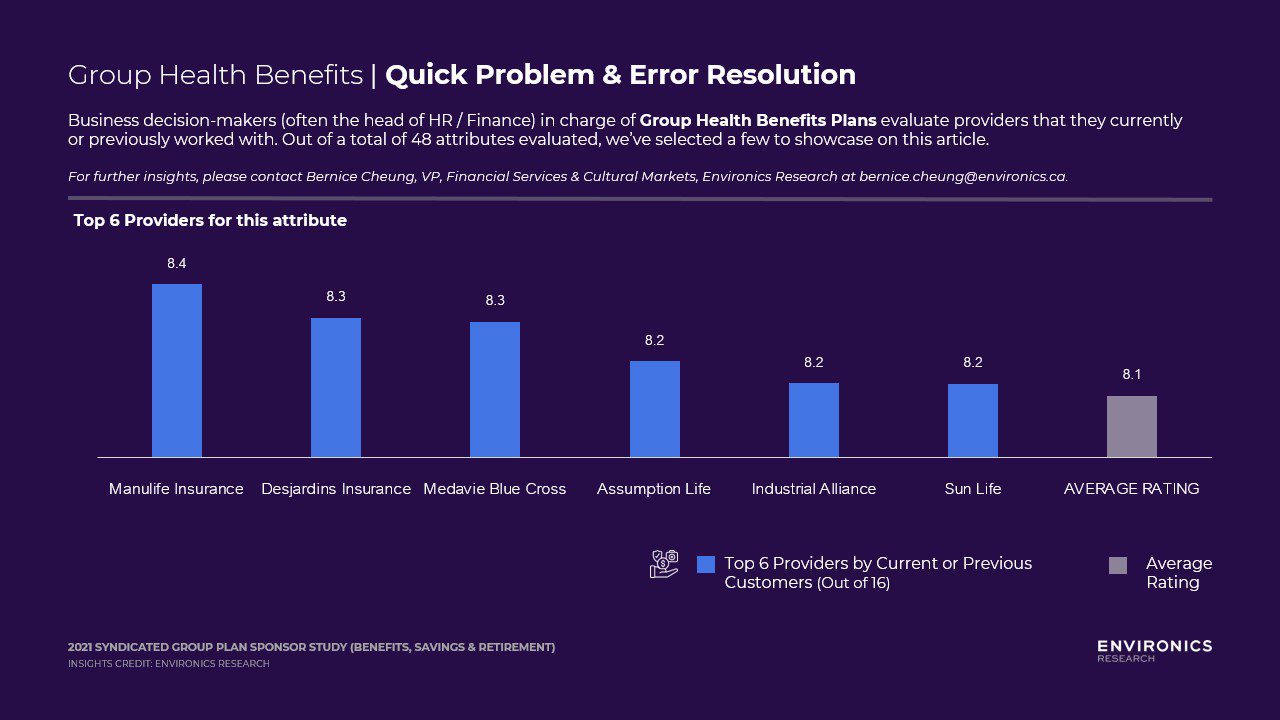

Group Health – Quick Problem & Error Resolution

Quick problem solving & error resolution resides in the Key Drivers quadrant within the back office / service dimension. Attributes that are Key Drivers have both a high stated importance and a high inferred importance, which means it is critical for providers to get right! Improving Key Drivers attributes yields the highest return for providers and it often helps plan sponsors differentiate between the provider they will select compared to others.

Manulife, Desjardins and Medavie Blue Cross are ranked by its customers as the leader in quick problem and error resolution. Providers not on the list should examine how quickly problems are resolved, whether it has a one-touch resolution, what its escalation process entails.

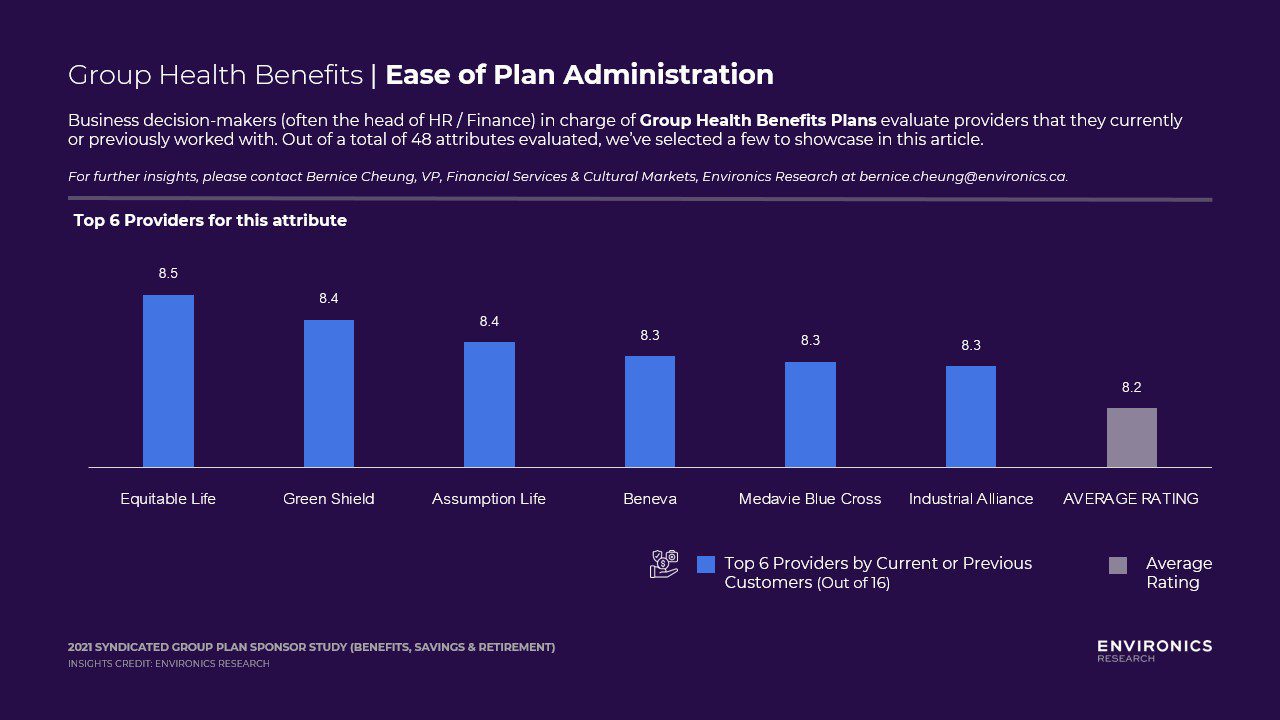

Group Health – Ease of Plan Administration

Ease of Plan Administration is also a key driver, within the Group Benefits Product dimension. Equitable Life, Green Shield, Assumption Life are ranked by its customers as the leader in Ease of Plan Administration. Those that do not make the top 6 list may want to examine top pain points or complaints from Group Plan Sponsors – which could include level of account manager’s handholding, instructions & self-help in administrating the plan, and etc…

Survey Highlights – Group Retirement & Savings

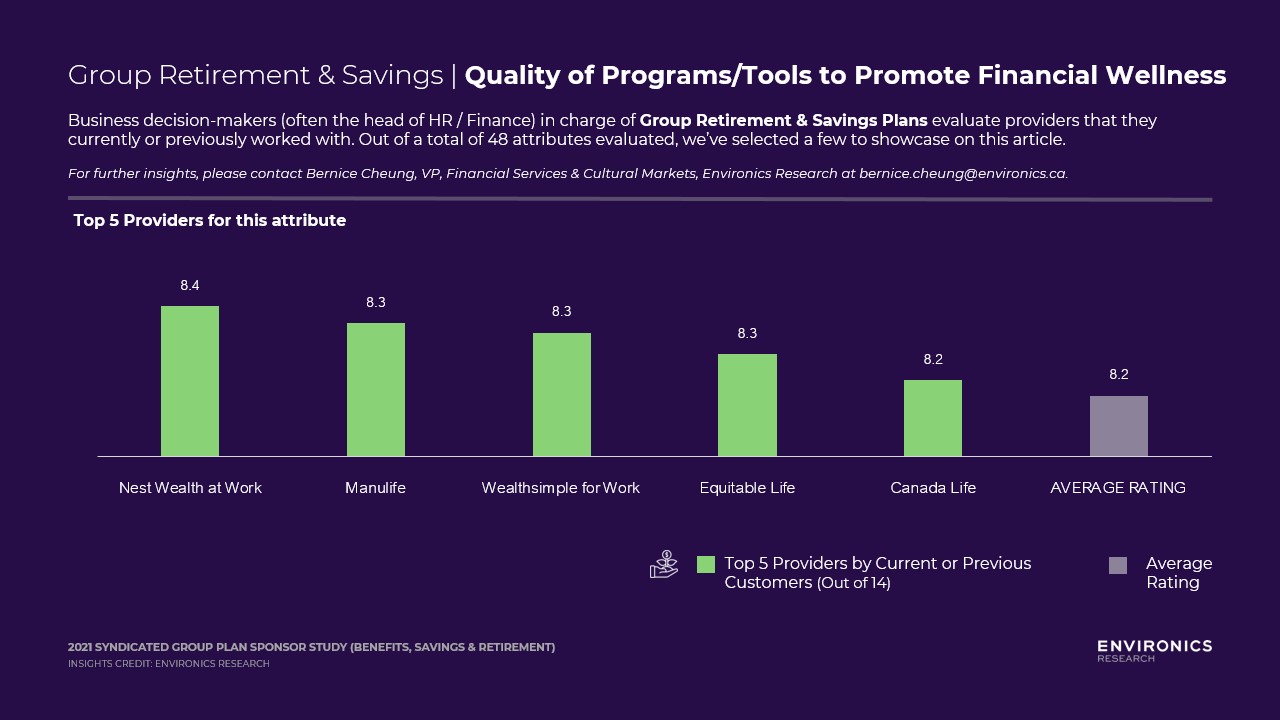

Group Savings – Quality of programs/tools to promote financial wellness

Quality of programs/tools to promote financial wellness resides in the Hidden Drivers quadrant within the Group Retirement product dimension, very close to being a Key Drivers. Hidden Drivers attributes have a lower stated importance, but a high inferred importance – which means that although group sponsors don’t believe they are crucial, these attributes actually do make a difference when plan sponsors are making decisions about the provider they select.

Nest Wealth, Manulife and Wealthsimple are ranked by its customers as the leader in Quality of programs/tools to promote financial wellness. These innovators can provide an accessible way that helps Group Members improve their financial wellness. Those that do not make the top 5 list may want to examine its program – whether or not the tools they offer are easy-to-use, easy-to-understand, especially for those who may not feel that they are financially savvy and confident.

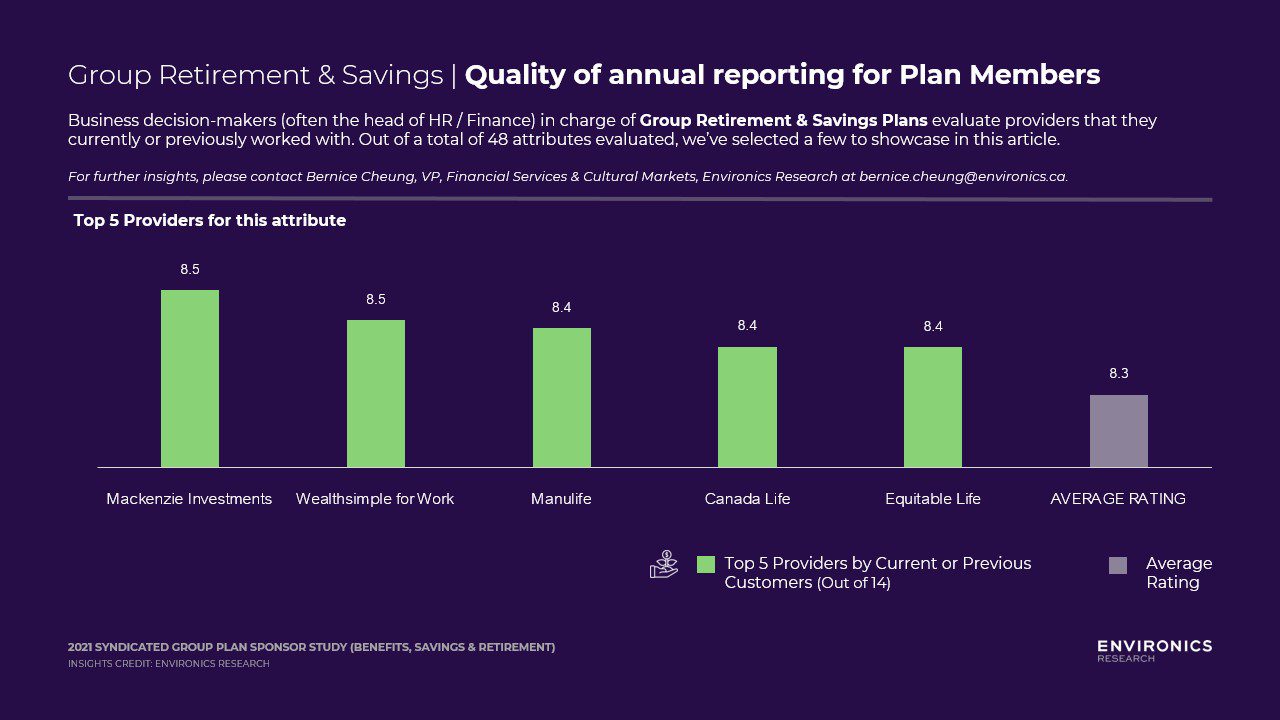

Group Savings – Quality of Annual Reporting

Quality of Annual Reporting is an attribute in the Table Stakes quadrant, but its position is very close to being a Key Driver. Table Stakes are those with high stated importance, but lower inferred importance. This means that although Group Plan Sponsors believe this to be an important attribute, it does not help differentiate one provider from the next. Mackenzie, Wealthsimple, and Manulife are ranked by its customers as the leader in Quality of Annual Reporting. Annual report style, clarity & simplicity of reports, and ease of access to these reports are areas for those who did not make the top 5 list to better understand.

Although summarizing all 48 dimensions isn’t possible here, a look at Net Promoter Scores (NPS) gives a general sense of how plan providers are seen. The first step in generating Net Promoter Scores for this study was to ask respondents, “Based on everything you know about each of the following, how likely are you to recommend these plan providers to other plan sponsors?”

Respondents answer on a 10-point scale, with 10 being most likely to recommend. The loyal enthusiasts who answer 9 or 10 are categorized as Promoters, while those who answer 6 or below are categorized as Detractors. (Those who answer 7 or 8 are categorized as Passives and discarded from the calculation.) Subtracting the percentage of Detractors from the percentage of Promoters yields the NPS, which can range from a low of -100 (every customer a Detractor) to a high of 100 (every customer a Promoter)

NPS Rankings for Health Benefits

Major long-term providers Sun Life, Manulife Insurance and Desjardins Insurance earn top spots in the NPS health benefits category, likely due to a combination of reputation and quality of service.

NPS Rankings for Retirement and Savings

Unlike in the health benefits category where established providers dominate, newcomers earn top spots in the retirement savings category. Fintech offerings with powerful digital platforms – notably Wealthsimple for Work and Nest Wealth at Work – have gained a strong, loyal following. Clients are responding to their innovative approach; traditional providers should take note.

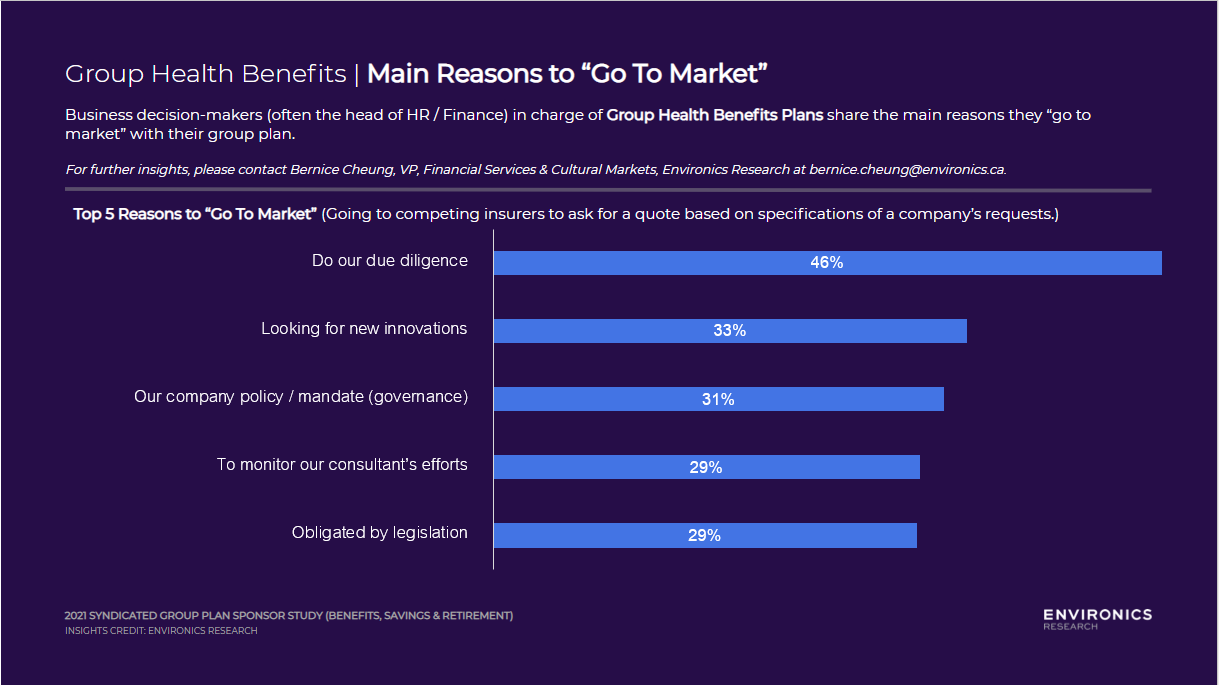

Why do Sponsors go to Competing Insurers to Ask for a Quote (“Go to Market”)?

While it is critical to understand the attributes that drive group plan sponsors to choose one provider over another, it is equally important to understand why they would “go to market” (ask for competing quotes) to begin the whole process.

Not surprisingly, many companies have company mandates to look for competitive bids at regular intervals or have legislation that requires them to do so. However, the most opportunistic reason that group plan sponsors are shopping around is that they are looking for innovation – representing a third of those surveyed. This speaks to a gap that their current plan may not contain the innovative ideas that they seek, thus an opportunity for providers to highlight new developments at the next conversation with plan sponsors.

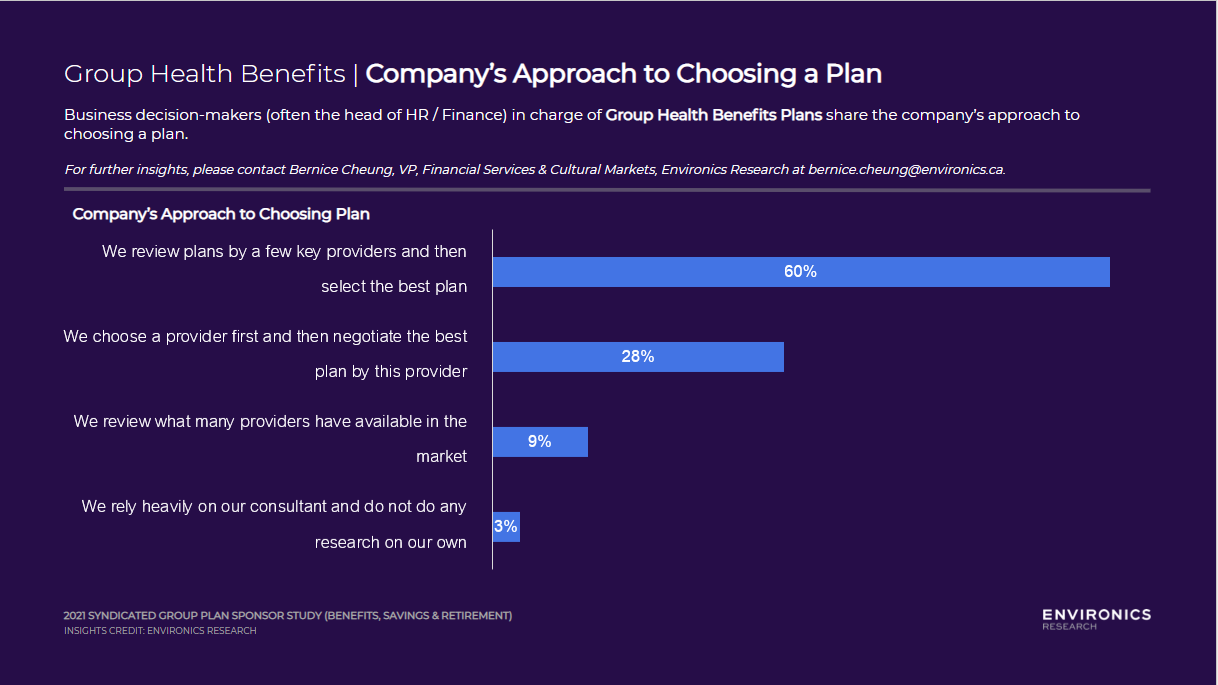

Company’s Approach to Choosing a Plan

While 80% of group plan sponsors work with an advisor or consultant, it is important to note that only 3% will completely trust their consultant and not do any of their own research. Majority of sponsors review plans by a few key providers and then select the best plan. This represents an opportunity for lesser-known providers to boost its company profile, so that its competitive quote may land on the table as one of the “few” for evaluation. Understanding and catering to the ultimate decision maker – group plan sponsors – is critical in this instance. It is then necessary to be laser-focused in speaking only about what sponsors consider as “Key Drivers” attributes and save some time highlighting attributes in the “Limited Opportunities” quadrant.

Top Health Risks Facing the Company

In our survey, we also asked group plan sponsors about the health risks that the company is currently facing. With the pandemic dragging on – constant mentions of restrictions and case counts, virtual school for children, and all the changes since 2019 have taken a huge toll on the mental health of employees. It is therefore top-of-mind for group plan sponsors (often head of HR) as the top health risk that companies are facing.

Sponsors’ Roles Shape Their Perceptions

In addition to gathering useful feedback about group plan providers, our survey revealed some other interesting patterns.

Organizations that have a dedicated group plan manager role tend to be more critical in their assessments of plan providers. This may be in part because the group plan point person in a large organization is often on the receiving end of employee queries and complaints – so they know the “pain points” and may sometimes experience their own pain in resolving them. In smaller organizations, meanwhile, where an owner or leader may select a group plan but rely on the plan provider for administration, we tended to find more favourable ratings – perhaps because in these scenarios, the plan provider would field employee concerns directly, often without the employer becoming involved.

More Insights to Come

We’re pleased to share these results from the first iteration of our new Syndicated Group Plan Sponsor study. As we field and analyze future surveys, we look forward to tracking changes in sponsor perceptions, covering specific industry topics in greater depth, and sharing key insights with clients and partners periodically through our website.

View our Syndicated Plan Sponsor Prospectus here.

For questions about this syndicated study or subscription information, please contact Bernice Cheung.

Find out how our Financial Services team can help your organization

Related insights

Toronto

366 Adelaide Street West

Suite 101, Toronto, ON

Canada M5V 1R9

416 920 9010

Ottawa

116 Albert St

Suite 300, Ottawa, ON

Canada K1P 5G3

613 230 5089

Calgary

421 7th Ave SW

Suite 3000, Calgary, AB

Canada T2P 4K9

403 613 5735