RRSP Season Is Here – How Not To Miss Out On The Lucrative New Canadian Market

ARTICLE BY

Bernice Cheung

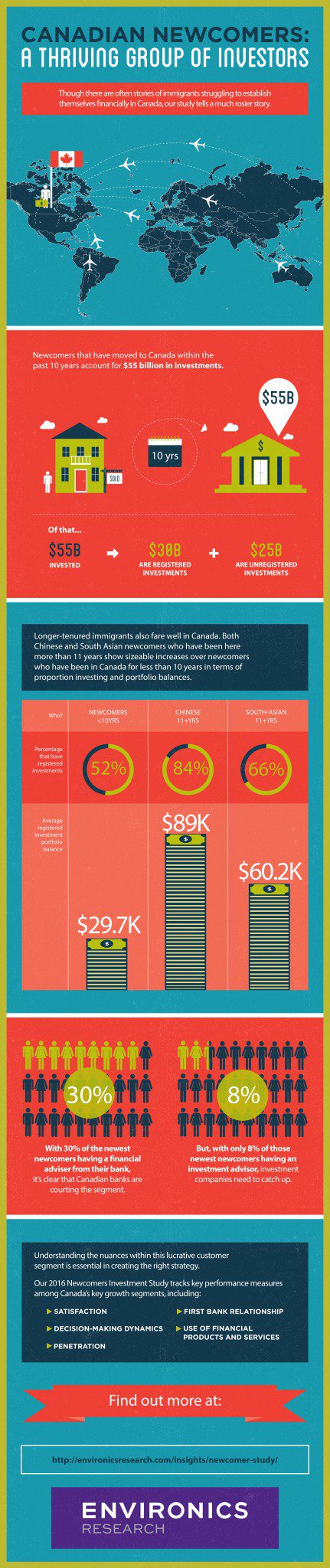

According to data from Environics’ Financial Services Among New Canadians Study, over half of all newcomers who immigrated to Canada less than 10 years ago have registered investment products, with an average balance of $29,700. With almost two million newcomers having immigrated to Canada in the past 10 years alone, that nearly $30 billion is spread across the entire country in the form of TFSA, RRSP, RESP and RRIF accounts.

Though we often hear stories of immigrants struggling to establish themselves financially in Canada, our study tells a much rosier tale. When comparing recent newcomers to those more tenured, we can see that not only are the latter more sophisticated in terms of investment strategy, but they also show significant growth in terms of portfolio value.

For example, 66% of longer-tenured South Asians (those having lived in Canada for over 11 years) have registered investments, with an average balance of $60,200. Chinese immigrants also fare especially well; an impressive 84% have registered investments, with an average balance of $89,000.

Although only 22% of new immigrants have mutual funds in their investment portfolios, the longer they are in Canada, the higher that percentage tends to rise. For longer-tenured Chinese, mutual fund ownership more than doubles, to 51%.

Major banks are clearly actively courting this lucrative group – 30% of the newest newcomers to Canada (those who moved to Canada 0-3 years ago) have a designated financial advisor at a major bank. Full service investment companies and brokers, however, appear to be missing out – only 8% of this high-potential group currently uses an investment advisor.

So, how can financial services companies approach this newcomer market? What are these new Canadians’ attitudes and financial goals? Understanding the nuances within this lucrative customer segment is essential in creating the right strategy. Environics Research interviews over 1,000 new Canadians every year to understand their attitudes, financial goals, product usage behaviours, satisfaction with their financial institutions, and much more.

To learn more about this opportunity, please contact Bernice Cheung, VP Cultural Markets, at Environics Research.

Find out how Environics can help your organization

Related insights

Toronto

366 Adelaide Street West

Suite 101, Toronto, ON

Canada M5V 1R9

416 920 9010

Ottawa

135 Laurier Ave W.

Ottawa, ON

Canada K1P 5J2

613 230 5089

Calgary

421 7th Ave SW

Suite 3000, Calgary, AB

Canada T2P 4K9

403 613 5735