Capturing The $4-Billion Credit Card Spending Of Canadian Newcomers

ARTICLE BY

Bernice Cheung

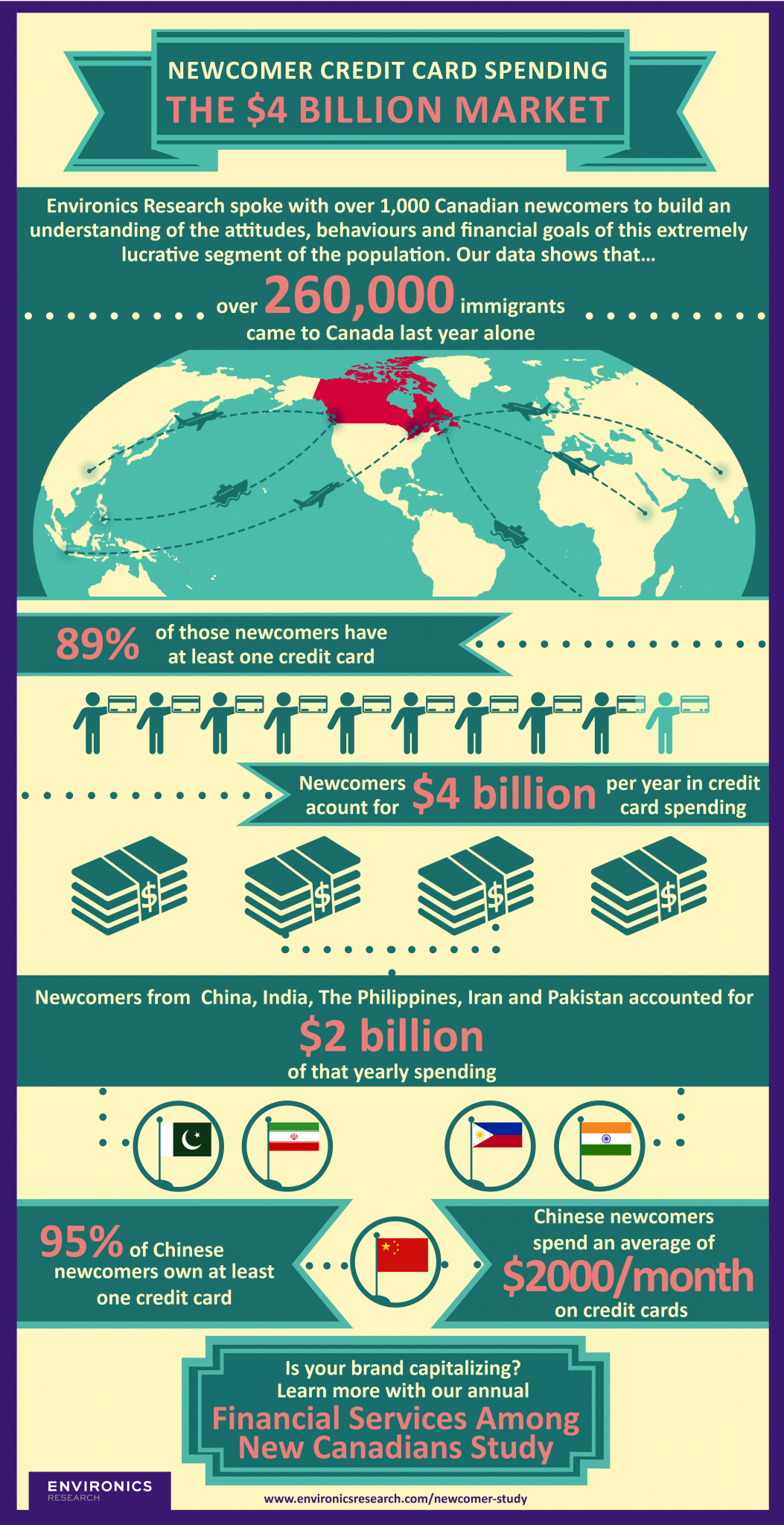

According to data from Environics’ Financial Services Among New Canadians Study, 89% of immigrants who have been in Canada less than 10 years have at least one credit card that they use regularly. With over quarter of a million immigrants coming to Canada last year, this represents a large opportunity for financial institutions.

The top five newcomer source countries – The Philippines, India, China, Iran and Pakistan – brought close to 129,000 immigrants in 2014 to Canada, and represent almost $2 billion spent per year on credit cards. Prepaid credit cards are essential to helping newcomers establish a credit history, especially at a time when they’re purchasing items for their new homes.

New immigrant households differ in that they’re younger, with larger families –composed of aging parents and young children. Only 40% of households headed by a Canadian-born resident have young children, compared to 64% of those in Canada less than five years who do. With aging parents and young children to care for, many immigrants prefer the convenience of credit cards to help manage their finances.

The top five newcomer source countries alone account for $2 billion/year spent on credit cards

Find out how Environics can help your organization

Related insights

Toronto

366 Adelaide Street West

Suite 101, Toronto, ON

Canada M5V 1R9

416 920 9010

Ottawa

135 Laurier Ave W.

Ottawa, ON

Canada K1P 5J2

613 230 5089

Calgary

421 7th Ave SW

Suite 3000, Calgary, AB

Canada T2P 4K9

403 613 5735