2024 Trends: Social Media in Canada

ARTICLE BY BRITTANY DENHAM

Social media is a growing presence in the day-to-day lives of Canadians. For many, social media platforms have become a primary communication method, news source, search engine, support group, educational resource and even marketplace. Recognizing which Canadians are using which platforms is crucial to understanding your audiences and how to reach them. So, in a dynamic and competitive social media landscape which platforms are most popular with Canadians?

General Usage Findings

In early 2023, Environics Research asked Canadians about their social media usage, finding that 87% were using at least one social media site on a weekly basis. We fielded the same survey questions in February 2024 to check for platform usage changes and emerging trends. This second survey found a slight uptick in the share of Canadians reporting weekly usage (88%). More Canadians now reported weekly usage of every platform we asked about; almost all platforms saw statistically significant increases relative to 2023.

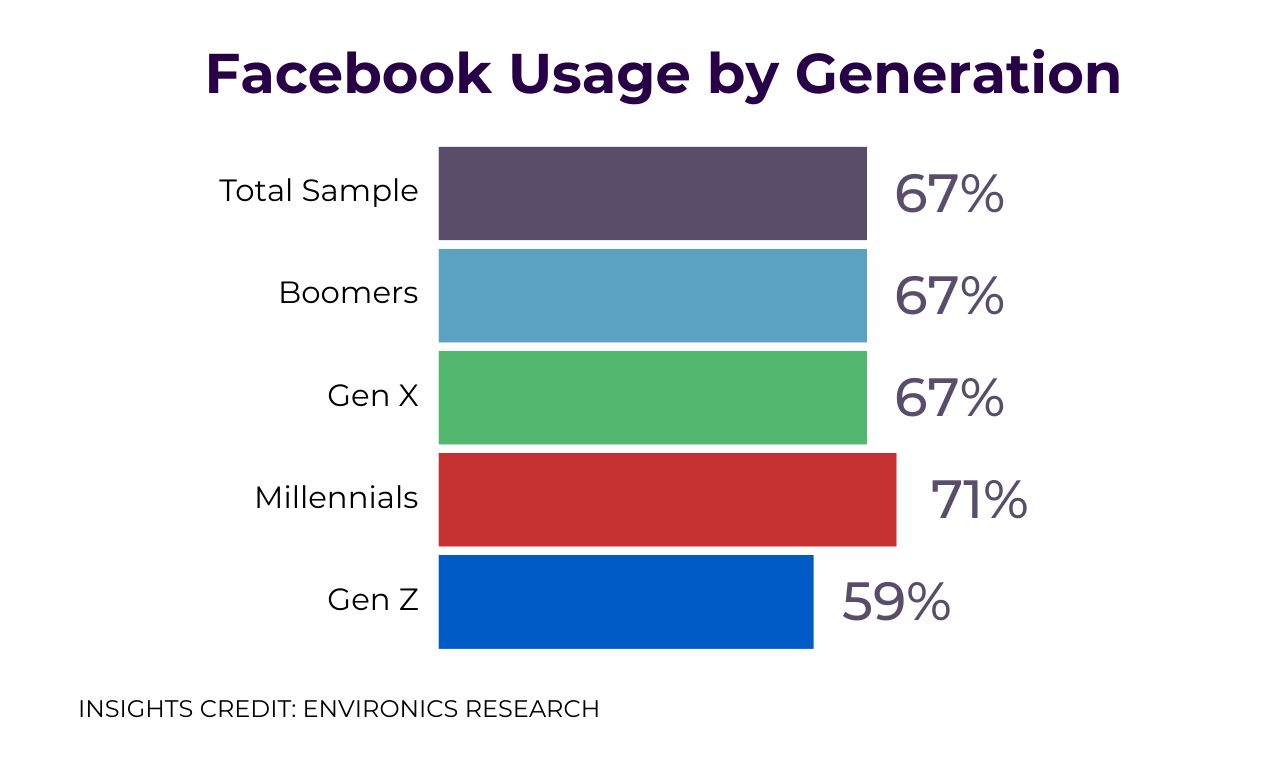

Facebook remains Canada’s most popular platform. Out of 2,103 Canadians surveyed in 2024, over two-thirds of respondents (67%) use Facebook at least weekly. After Facebook, the next most used platforms are YouTube (54%) and Instagram (41%), which saw large increases in weekly usage year-over-year: +5% and +7% respectively. However, TikTok is the platform seeing the most significant usage increase. Just 10% of Canadians said they used TikTok on a weekly basis in early 2023; that’s almost doubled to 18% in early 2024. TikTok now matches X (formerly Twitter) in the share of Canadians reporting weekly usage.

The older, more established platforms (Facebook and X) saw smaller changes in usage from 2023 to 2024, up 3% each year-over-year. While these increases are nominal, they are interesting given the changes made to both platforms in the past year.

Meta issued somewhat disruptive changes to Facebook and Instagram in Summer 2023 by removing the ability for Canadians to share or view links to news sources. This was in response to Canada’s enactment of Bill C-18, the Online News Act, which required social media platforms to compensate mainstream news publishers for their content. It seems this new restriction on access to news has not hurt weekly usage of Facebook or Instagram. Instead, some have found ways to continue sharing news on Meta – for example, by using screenshots or sharing links from non-traditional news sources such as blogs.

Platform changes and challenges at X seem not to have dampened Canadian usage, although regular use of X remains much lower than Facebook, YouTube and Instagram. Continued accusations of X being used to spread disinformation or allowing hate speech to go unchecked has not eroded regular usage. Nor has usage declined in response to news that X was considering charging all new users a small fee to post on the platform. Likewise, despite the immense amount of media attention covering the launch of Meta’s Threads in Summer 2023, our findings suggest that Threads has not yet posed much of a threat to X in Canada. It seems the X has been able to weather the storms; more Canadians are active there now than in 2023.

These year-over-year movements are interesting, but only tell part of the story of Canadians’ changing media habits. A more complex picture emerges when we examine who is using each social media platform and how differences between active audiences can explain platform trends.

Generation Usage

Overall, Canadians reported using 2.6 social platforms on a weekly basis compared to 2.5 in 2023. Generational differences are significant. Millennials and Gen Z use a greater number of platforms than Gen X and Boomers – and younger Canadians continue to broaden their usage. Boomers (1.8, unchanged) and Gen X (2.4 compared to 2.5 in 2023) report little change in their platform usage. Millennials now use an average of 3.4 platforms weekly, up from 3.1 in 2023 while Gen Z use 3.9 (up from 3.2). Facebook is the most used social platform for all generations except Gen Z; for this youngest generation, Instagram (75%) and YouTube (71%) are the most used platforms.

TikTok is significantly more popular among Millennials and Gen Z than among older generations – and the platform has gained ground among both cohorts over the past year. Compared to 2023, weekly TikTok usage among Millennials has risen 11 points (from 13% to 24%) and among Gen Z it’s risen 17 points (26% to 43%).

Gender Differences by Generation

Within generations, gender makes little difference to how much Canadians use social media – but it does seem to shape their platform choices. Facebook (70%), YouTube (49%) and Instagram (46%) are the most used platforms among women overall. Instagram, the top platform for Gen Z, is used by 86% of Gen Z women. For women in all other cohorts, Facebook is #1.

For men overall, Facebook (63%) is also the most used platform, followed by YouTube (60%) and Instagram (36%). These average rankings obscure a slightly more nuanced story: Boomer men are significantly less likely to use YouTube (42%) while YouTube is the most used social platform for Gen Z (76%), Millennials (73%) and Gen X (63%). Millennial (31%) and Gen Z (33%) men are also the most likely groups to use X.

Social Values

Looking beyond generation and gender differences, Canadians hold increasingly diverse Social Values that help drive consumer motivations and behaviours. Overall, Canadian social media users tend to over-index on key values such as Pursuit of Novelty and Joy of Consumption. But we also find some variations in values among users who gravitate to different platforms.

Facebook users score high on Confidence in Advertising and Consumption Evangelism, showing an acceptance of consumerism. Among Instagram users, we see values that prize image and display; the values Status via Home and Ostentatious Consumption are some of the top values for these users. TikTok users show higher scores on Personal Creativity and Attraction to Crowds, this is perhaps unsurprising as the platform is known for unique content-creation strategies.

X users seem to stand apart from the rest – a difference that may result from the high concentration of male users. Enthusiasm for New Technology rises to the top for X users. This finding jells with owner Elon Musk’s reputation as a tech innovator, and the large number of superfans who follow his thinking and activities via X.

Among LinkedIn users, we continue to see social and status-oriented values over-index. They score high on Need for Status Recognition, Ostentatious Consumption and Consumer Evangelism. Likely due to the professional nature of the platform, LinkedIn users value a professional image and strive to be leaders; they want to celebrate their successes and seek validation for their accomplishments.

Why does the current state of social media matter?

The social media landscape moves quickly. Since MySpace launched in 2003, many platforms have come and gone. Some proved to be a flash in the pan (Vine, BeReal), while others have transformed culture, politics and economies (Facebook, YouTube).

With rumours of TikTok launching a photo and text platform in the near future as a direct competitor to Instagram, it will be critical for advertisers and marketing teams to follow platform growth and demographic usage. TikTok and Instagram are increasingly popular amongst Millennials and Gen Z; a new platform combining the most appealing aspects of both platforms has the potential to powerfully disrupt the social media landscape – or fizzle like Threads. Contrarily, there is also the possibility the TikTok could be removed from app stores in the United States as parent company DanceByte is fighting the recently passed legislation requiring the company to break ties with China, sell the app to a third-party or exit the United States. This could impact TikTok’s North American strategy as a whole and cause a disruption to how Gen Z uses social media.

It can be hard to keep pace with the constant changes in the social media landscape. But the simplest finding of our survey may also be the most important: social media usage across all groups is high and still growing. Individual platforms are also gaining strength. In this context, it’s crucial for companies to understand each platform’s audiences and how they’re changing through social intelligence. A message that resonates with the X audience may fall flat on TikTok. High-quality data – including tracking data that shows trends over time – can help brands refine their strategies, tailor their approaches for each environment, and ultimately ensure the success of their campaigns.

Find out how our Social Intelligence team can help your organization

Related insights

Toronto

366 Adelaide Street West

Suite 101, Toronto, ON

Canada M5V 1R9

416 920 9010

Ottawa

135 Laurier Ave W.

Ottawa, ON

Canada K1P 5J2

613 230 5089

Calgary

421 7th Ave SW

Suite 3000, Calgary, AB

Canada T2P 4K9

403 613 5735