Are Some Advisors Overlooking Important Insurance Sales Opportunities?

ARTICLE

BY DAVID MACDONALD

Now in its 26th year, the annual Environics Advisor Perception Study is the most comprehensive study of Canada’s investment and insurance advisors. This study looks at advisors, their practices and the brands they choose to work with, including the factors that are driving brand loyalty.

Advisor Insurance Sales

In 2021, the Advisor Perception Study captured feedback from more than 3,000 top-producing independent (non-career/captive agent) advisors on their insurance and investment sales. Nearly two-thirds of advisors are dually-licensed, able to sell both mutual funds and insurance products; just under two in ten are licensed to sell only insurance products while a similar proportion are licensed to sell only mutual funds. However, we find that actual sales are more focused than licensing status might suggest, with only four in ten reporting that they sell both mutual funds and insurance products. A majority of advisors focus exclusively in one area or the other: one-quarter of advisors sell only insurance products while one-third sell only mutual funds.

While product specialization can help advisors focus on what they know best, many advisors may be leaving potential sales on the table by not understanding the opportunities with their clients. In our study, in addition to asking what they are licensed to sell, we ask whether advisors are focused on insurance or investment sales. Doing so allows us to segment advisors and gain insight into their business focus and associated sales practices.

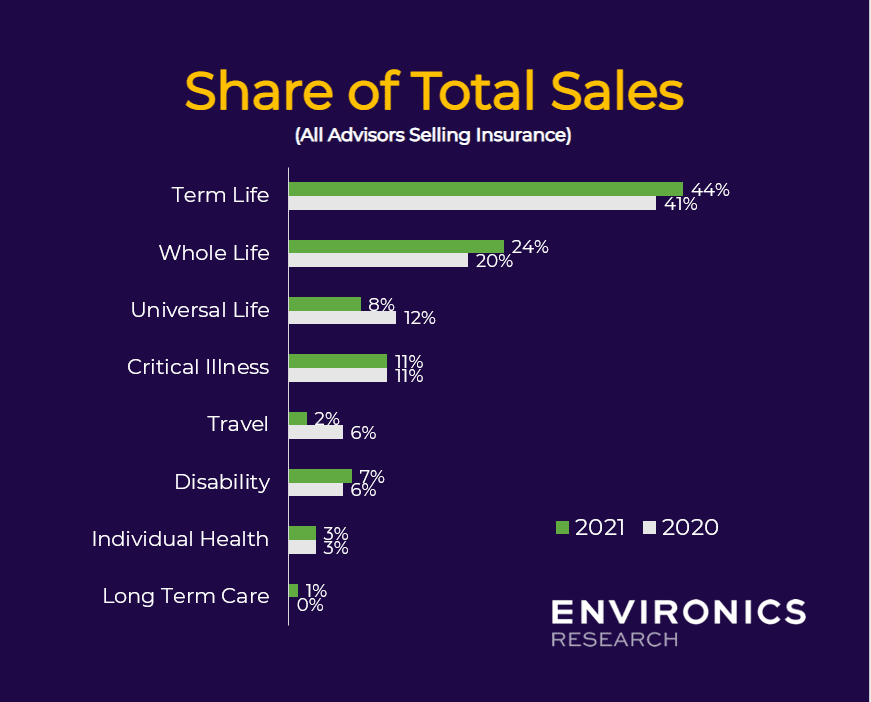

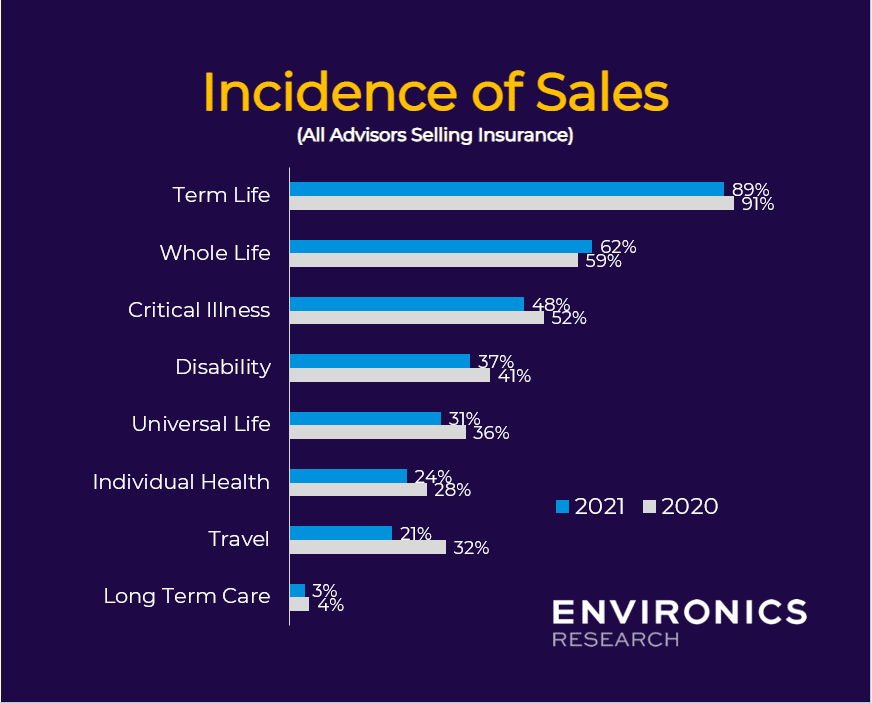

Unsurprisingly, advisors who focus entirely or mostly on insurance have significantly greater insurance sales – reporting median first-year premiums about double those reported by advisors who focus on investments. Insurance-focused advisors also report very different use of products in their practices. The two charts below show the proportion of advisors selling each product type (sales incidence) and the proportion of all advisors’ insurance sales that each category represents (share of sales). For example, while most advisors – 89 percent – offer term insurance, it represents 44 percent of advisors’ sales.

Breaking the data down further shows that while there is little difference in the sales incidence between advisors by licensing, when it comes to share of sales the differences are greater. Term insurance makes up a significantly greater share of IIROC-licensed advisors’ sales (61%) and MFDA-licensed advisors’ insurance sales (47%); for advisors whose focus is entirely or mostly insurance sales, term insurance represents a smaller share (35%) – suggesting that these advisors see opportunities to connect their clients with a wider range of appropriate products, which investment-focused advisors might be missing. In terms of permanent insurance for example, 62 percent of all insurance-licensed advisors sell whole life, while a smaller 31 percent offer universal insurance, for a combined total of 71 percent. Here, we see that in terms of sales incidence, IIROC-licensed advisors (61%) and MFDA-licensed advisors (62%) trail those who sell entirely or mostly insurance (85%) by a wide margin. With lower incidence of sales, permanent insurance represents a minor proportion of sales for MFDA and IIROC-licensed advisors.

Advisor Opportunities in Disability and Critical Illness Insurance

Outside of life insurance, we see fewer advisors offering living benefits policies overall. While the decline in travel insurance makes sense considering COVID-19 travel restrictions, the pandemic should have heightened Canadians’ awareness of the very real risks of long-term employment disruption that unforeseen health problems can present. Yet fewer than half of advisors sold critical illness policies in 2021 and only 37 percent sold disability insurance; both figures fell from 2020 levels. Even fewer advisors sold individual health insurance or long-term care insurance, the latter a category that is ripe for sales growth after the ravages of COVID-19 uncovered fundamental shortcomings in Canada’s publicly funded long-term care system.

In each of these categories, IIROC and MFDA-licensed advisors lag behind advisors whose primary focus is insurance. Collectively, all of them may be overlooking significant sales opportunities. In 2021, the Public Health Agency of Canada released a report estimating that 2 in 5 Canadians will be diagnosed with cancer in their lifetime and about 1 in 4 will die from it. Cancer is the leading cause of death in Canada. While the proportion of first cancer diagnoses peaks between the ages of 65-69, for 37 percent of men and 45 percent of women who are diagnosed, their first diagnosis occurs during their primary working years. Despite these trends, only 62 percent of working Canadians have workplace group health benefits programs. Roughly four in ten have no workplace health coverage at all, and even among the 62 percent who do have benefits through their employers, the coverage may not be sufficient to meet their families’ needs – a particular concern for those with very large mortgage balances.

What Advisors seek from Insurance Companies

Advisors report selling products from an average of 2.2 living benefits companies in 2021, unchanged from prior years. The most frequently sold carriers include Manulife, Canada Life, RBC Insurance and iA Financial. When choosing between carriers, dimensions like fast/efficient underwriting, flexible underwriting processes and in-force policy servicing are table stakes – carriers are expected to perform well on these dimensions and companies that are overly restrictive or offer poor service are simply dropped by advisors.

Where carriers can stand out from competitors is in terms of the quality of products, competitive product pricing and, notably, the corporate reputation and image of the company. Companies with strong products backed by strong brands that advisors can rely upon become go-to carriers in the living benefits space. Beyond these, online tools, new business/service apps and advisor training and education materials are important drivers of sales, too.

Conclusions

Whether focused on investments or insurance, advisors of all types should encourage their clients to review their disability and critical illness insurance coverage to ensure they and their families are adequately protected from unexpected health issues that may impact their ability to earn an income. In doing so, advisors will find they learn more about their clients’ complete financial picture and will be seen as a partners in their clients’ well-being.

Insurance companies can support advisors in growing their practices by showcasing their disability and critical illness products within their broader lineup of living benefits offerings. Developing advisor support materials, illustrations and case studies will enable advisors to showcase their products and cement insurers’ relationships with advisors.

Find out how our Financial Services team can help your organization

Related insights

Toronto

366 Adelaide Street West

Suite 101, Toronto, ON

Canada M5V 1R9

416 920 9010

Ottawa

135 Laurier Ave W.

Ottawa, ON

Canada K1P 5J2

613 230 5089

Calgary

421 7th Ave SW

Suite 3000, Calgary, AB

Canada T2P 4K9

403 613 5735